Real-world asset tokenization is making waves in traditional investment sectors. In the age of Web2, property ownership and investments face limitations with manual processes and underwriting, contracts, and asset values determined by the market, and local currencies. Wall Street investors and property owners are skeptical of utilizing the world of Web3 for real estate–and that’s where real-world asset tokenization is coming in.

In an unlikely move, Blackrock, one of the world’s largest asset management firms, dipped its toes into Web3 waters with a Bitcoin ETF and an expanded money market fund, BUIDL, in partnership with Securitize. The firm aims to tokenize $10 trillion of its assets.

But what drew the firm towards decentralized finance?

Smart Contracts, Blockchain, and Property Ownership Verification – Where DeFi Fits In

Blackrock’s investment in tokenization signifies a response to the growing inefficiencies in traditional asset management and growing challenges for property ownership. Tokenization increases liquidity, reduces transaction times, and enhances transparency for all parties involved in real estate transactions, making real estate more accessible. Unlike traditional markets that rely on slower processing for verification and intermediaries that cause delays, blockchain and its innovations enable near-instant, verifiable transactions across chains with immutable data, making large-scale property investments more secure.

By tokenizing real estate, firms and smaller property owners can fractionalize property ownership, allowing more investors to participate in high-value markets, and own portions of high-value investments–similar to a basket of securities when investing in stocks or bonds. This shift is revolutionary for a new investment subcategory within real estate, driving value for large investment firms like Blackrock.

Additionally, blockchain is solving long-standing real estate inefficiencies in property transactions. Traditionally, property sales require extensive documentation, at times in physical documents, and third-party involvement, leading to delays and added costs.

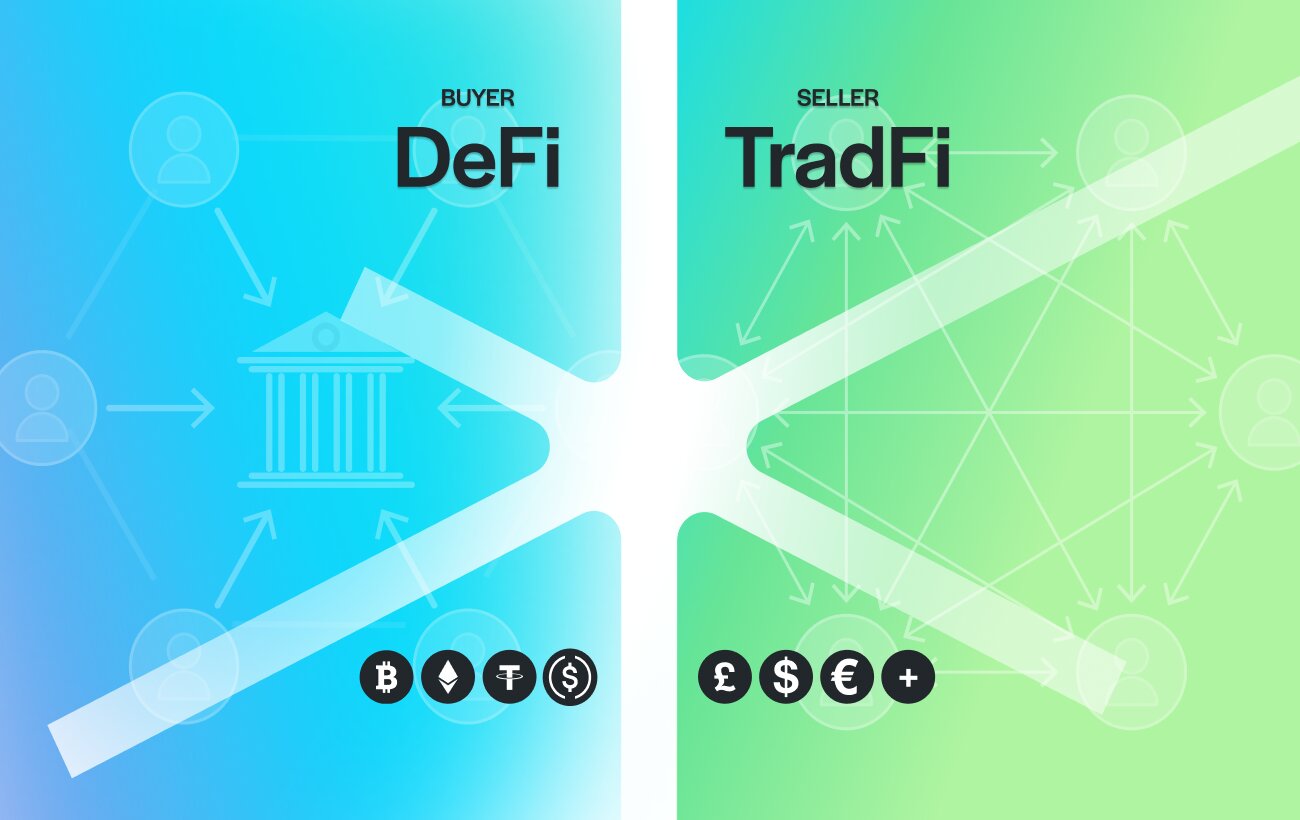

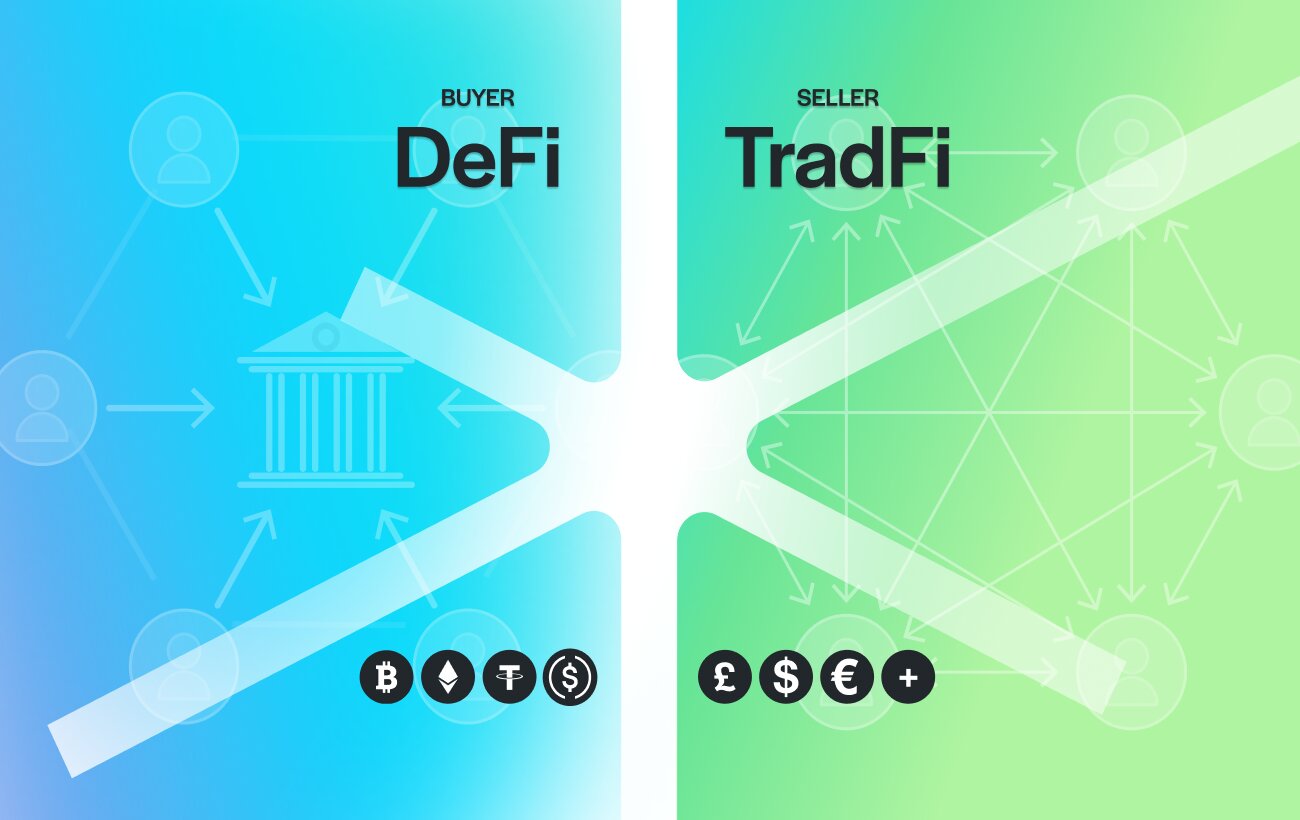

Smart contracts automate essential processes between buyers and sellers, such as property transfers, rental payments, and compliance checks, ensuring all terms are met before execution. These contracts eliminate the need for intermediaries like escrow services and additional legal parties, streamlining the buying process while reducing risks.

The Need for Streamlined Intermediaries Across Property Lines (And Countries)

International property buyers can face significant challenges, including currency conversion feed, banking restrictions, and extended settlement times. Traditional financial intermediaries often complicate and add more steps (and costs) to the process.

Blockchain solutions reduce these barriers by enabling cross-border transactions without reliance on slower systems. By leveraging smart contracts and eliminating intermediaries, blockchain can enhance transaction speed, transparency, and efficiency.

How TrustLinq is Revolutionizing Crypto Real Estate Investments

TrustLinq bridges the gap between crypto and traditional finance, offering investors seamless options for converting digital assets into real estate holdings. Our platform simplifies cross-border property transactions, allowing users to enter a recipient’s bank details, convert crypto to fiat, and finalize payments with ease, whether making an individual mortgage rent payment or purchasing a new property.

TrustLinq is offering innovative solutions to meet an evolving real estate market worldwide–as the future outlook of property investment and ownership integrates new opportunities for blockchain adoption.

Try out TrustLinq today to unlock new real estate possibilities. Sign up at www.TrustLinq.com.