The cryptocurrency world has been focused on convincing merchants to accept digital currency, expecting sellers to adopt crypto payment systems that often require complex API integrations and leave businesses holding and managing cryptocurrencies. At Trustlinq, we believe this approach misses the mark. Sellers shouldn’t be forced into the world of crypto if they aren’t ready, and they shouldn’t be expected to navigate the technical and financial challenges of dealing with digital assets just to accommodate a small percentage of their clientele.

Instead, we’re turning the industry on its head. We believe that it’s time to take a bold new approach that respects the needs of sellers while empowering crypto holders to access goods and services seamlessly. The crypto world has gotten it wrong by focusing on merchants. Trustlinq’s solution? Focus on the crypto holders and enable them to transact in the traditional economy without changing the way sellers do business.

The Current Approach is Holding Back Crypto Adoption

The existing approach in the cryptocurrency industry has been focused on trying to pull sellers into the digital currency ecosystem. Crypto processors expect merchants to accept cryptocurrency payments, which requires businesses to set up complex integrations, adopt APIs, and accept the risks of holding or converting digital assets. While these solutions are technically sophisticated, they overlook a fundamental reality: most sellers aren’t ready to embrace crypto.

Why? Because many sellers are simply not prepared to manage cryptocurrency’s volatility, deal with regulatory concerns, or integrate complex payment systems. For most businesses, their priorities remain rooted in traditional commerce. The current industry approach tries to push sellers where they don’t want to go, leading to slow adoption and low integration rates.

Trustlinq’s 180-Degree Solution: Empower the Crypto Holders

Rather than forcing businesses to accept cryptocurrencies, Trustlinq recognizes and respects the reality of today’s market. Sellers are already set up to receive traditional payments through bank transfers. Why should they need to change anything?

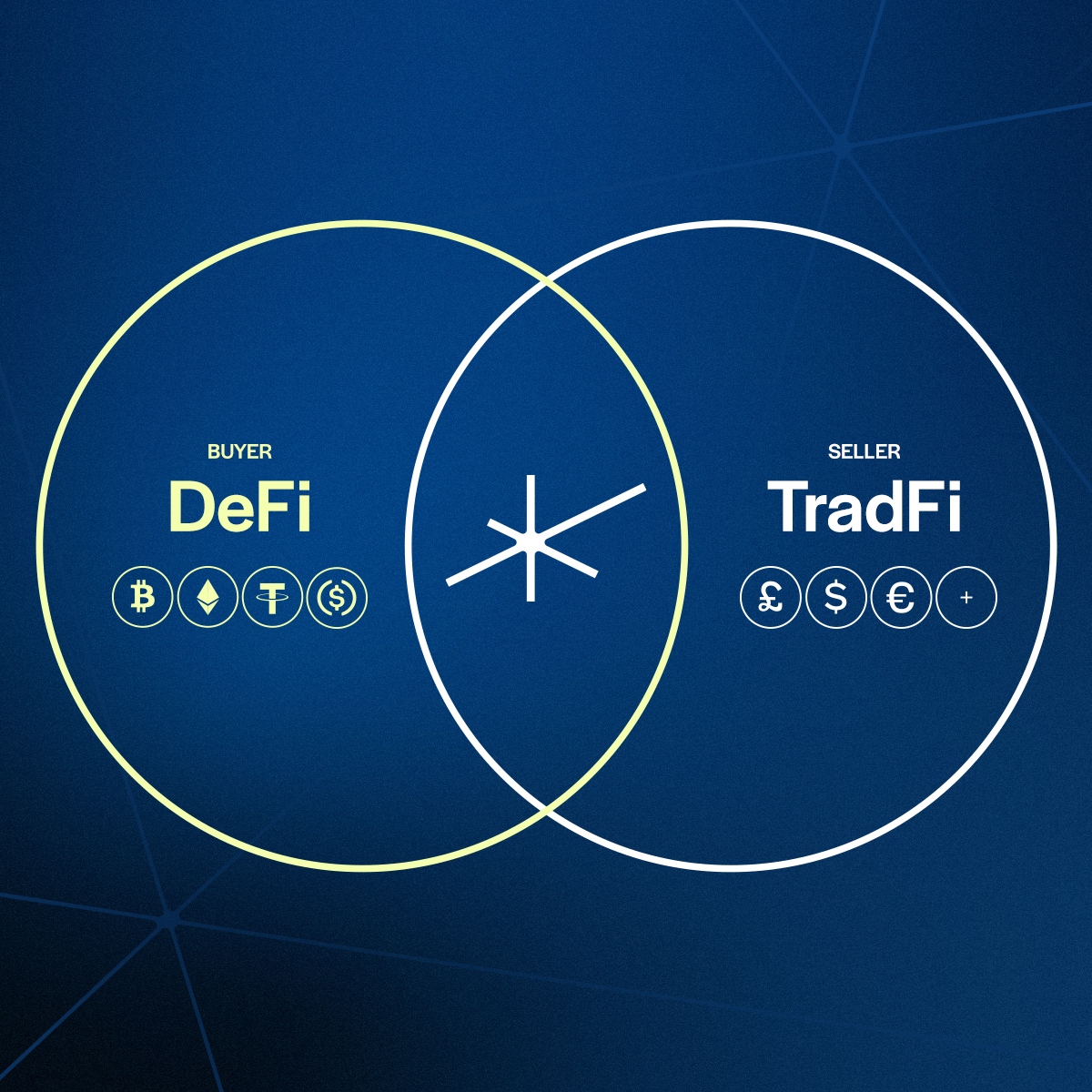

Our solution flips the script: We focus on the crypto holders—the individuals and businesses who already own digital currency and want to spend it. With Trustlinq, crypto holders can access traditional sellers without expecting those sellers to change their operations or take on unnecessary risks.

Our platform facilitates crypto-to-fiat transfers that allow sellers to receive fiat payments directly, while crypto holders pay in their preferred digital currency. This approach respects the seller’s existing setup, while still allowing crypto holders to enjoy the flexibility of spending digital assets.

Why the Industry Needs to Re-evaluate Its Priorities

The current industry thinking is stuck in a narrow perspective that insists on “bringing sellers into the crypto world,” regardless of whether they’re ready. This approach, however, creates friction, with most businesses preferring to stick with familiar payment processes rather than jumping into a new, complex, and volatile financial model.

By focusing on crypto holders instead of sellers, Trustlinq opens the door to widespread crypto adoption without changing the way businesses already operate. Crypto holders gain the freedom to spend digital currency on goods and services, while sellers receive traditional fiat payments without lifting a finger or changing their financial setup. This approach is simple, scalable, and far more practical for mainstream adoption.

How Trustlinq’s Approach Benefits Both Sellers and Crypto Holders

- Respecting Sellers’ Preferences: Trustlinq’s solution acknowledges that sellers want to keep doing business as they always have, with minimal disruption. Our model allows sellers to receive fiat currency directly, eliminating the need for complex integrations or cryptocurrency management.

- Seamless Access for Crypto Holders: By focusing on the crypto holders, we empower individuals and businesses who are already in the digital economy to transact easily with traditional sellers. Crypto holders can use their digital currency for everyday purchases, while Trustlinq’s system handles the conversion and transfer on their behalf.

- A Practical Solution for Today’s Market: Instead of pushing businesses to adapt to crypto, Trustlinq meets them where they are. We bridge the gap between crypto and fiat economies without requiring either side to compromise.

Changing the Narrative: Trustlinq is Here to Simplify, Not Complicate

At Trustlinq, we’re taking a 180-degree approach to crypto adoption. We believe that the key to mainstream adoption isn’t forcing sellers to change their payment models but enabling crypto holders to access traditional markets without barriers. It’s time for the industry to recognize that adoption isn’t about coercion; it’s about respect, understanding, and finding practical solutions.

Trustlinq is here to set a new standard. We envision a future where crypto and fiat systems coexist effortlessly, where crypto holders can transact as easily as anyone else, and where sellers can participate in the digital economy without taking on risk. The future of crypto adoption doesn’t rest on convincing sellers to change—it’s about providing crypto holders with seamless access to the traditional economy.

Join us in changing the game. Let’s create a world where digital and traditional finance work together effortlessly, enabling true freedom and flexibility for all.