As the regulatory environment across Europe evolves — particularly under frameworks like MiCA (Markets in Crypto-Assets Regulation) — many individuals and businesses are finding that financial privacy is becoming increasingly difficult to maintain. While MiCA brings clarity and structure to the digital asset space, it also introduces broader data-sharing and disclosure mechanisms that may feel intrusive to some.

By contrast, Switzerland continues to take a balanced approach — one that aligns with international compliance standards, but still prioritizes client confidentiality and personal data protection. For those who value financial privacy without compromising legality, Switzerland offers a clear advantage.

At TrustLinq, our decision to operate under Swiss regulation is deliberate. It allows us to offer our clients unparalleled privacy protections and a level of trust that few other jurisdictions can match — all while maintaining full regulatory compliance.

The Legacy of Swiss Banking Privacy

Swiss financial institutions have long operated under a strict legal obligation to protect client data. This tradition goes back nearly a century, to the Swiss Banking Law of 1934, which made it a criminal offense to disclose client information without proper legal justification. Today, that tradition has evolved to align with international standards, but the essence remains: client data privacy is a legal right in Switzerland.

Unlike other jurisdictions where data might be more readily accessed or exchanged between agencies, Switzerland protects client information by default — requiring a high legal threshold for any disclosure. This provides a unique advantage for individuals and companies seeking a secure, neutral environment for financial operations.

How TrustLinq Clients Benefit from Swiss Legal Protections

Because TrustLinq is a Swiss-registered and regulated financial intermediary, all of our clients automatically fall under Switzerland’s data protection and financial privacy framework. Here’s what that means in practice:

- Confidential handling of your financial information

Your data is never shared without legal grounds or your explicit consent. - Advanced regulatory protection

Switzerland’s Federal Data Protection Act (FDPA) and Financial Services Act (FinSA) ensure your personal and financial information is shielded by one of the world’s most robust data protection regimes. - Jurisdictional neutrality

Switzerland is famously neutral — politically, economically, and in its regulatory posture. This benefits international clients seeking consistency and stability. - Peace of mind in digital finance

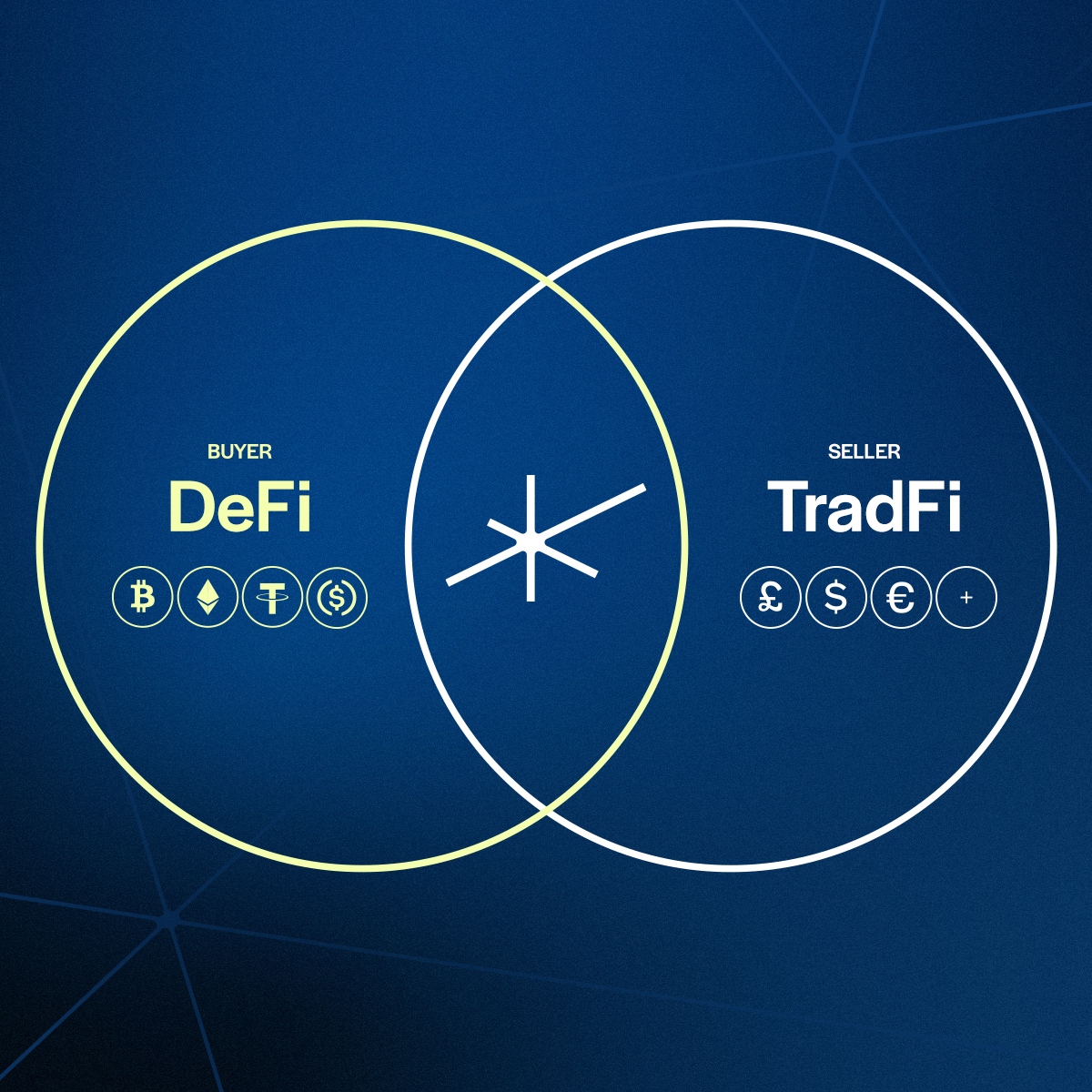

Whether you’re moving digital assets or requesting fiat settlements, you’re operating from one of the most crypto-friendly and privacy-conscious jurisdictions in the world.

Balancing Compliance and Discretion

Switzerland is fully aligned with international efforts to combat money laundering, terrorist financing, and tax evasion. All Swiss-based institutions, including TrustLinq, must conduct full KYC (Know Your Customer) and AML (Anti-Money Laundering) checks.

However, once a client is properly onboarded and verified, Switzerland’s legal environment continues to prioritize confidentiality. This balance is part of what makes it so attractive: it’s not about avoiding rules — it’s about ensuring those rules don’t compromise your right to financial privacy.

Why Switzerland Still Stands Apart in a Transparent World

In a time when digital surveillance is growing and financial data is increasingly accessible, Switzerland remains one of the few countries where privacy still means something.

Clients working with TrustLinq benefit from:

- A stable, pro-business environment

- Strong safeguards around financial data and digital asset use

- A legal framework that respects individual and institutional discretion

Whether you’re managing wealth, handling international business payments, or converting crypto into fiat currencies, Switzerland provides the ideal base — and TrustLinq is here to help you make the most of it.