For the 99.5% of sellers not accepting crypto directly.

In today’s digital age, more than 420 million people worldwide hold cryptocurrency, and that number is growing rapidly. Yet, despite this massive potential customer base, many businesses remain hesitant to accept cryptocurrency due to concerns over complexity, compliance, and currency stability. At Trustlinq, we offer a solution that lets businesses tap into this expansive market without actually needing to handle cryptocurrencies. Our platform is designed to make the process as straightforward and familiar as possible, with payments in fiat currency directly to your account in one of over 70 supported currencies.

Why Enter the Cryptocurrency Market Now?

Crypto adoption continues to rise, especially among younger individuals who see digital assets as part of their daily lives. By accepting payments through Trustlinq, your business can access a segment of this global market, driving revenue from a customer base that previously may not have been available. Here’s a look at some of the growing markets:

- North America: Over 50 million people own cryptocurrency, many of whom prefer to transact with businesses that offer crypto payment options.

- Europe & UK: An estimated 45 million individuals hold crypto assets, with a significant number seeking ways to spend their digital holdings on goods and services.

- Asia: Home to one of the largest and most enthusiastic crypto user bases, Asia hosts over 160 million crypto holders across various regions.

These regions represent millions of potential customers who are ready to spend their digital assets but are limited by businesses that don’t yet accept crypto payments. Trustlinq helps you connect with this untapped audience without altering your current financial processes.

How Trustlinq Simplifies Crypto Payments for Your Business

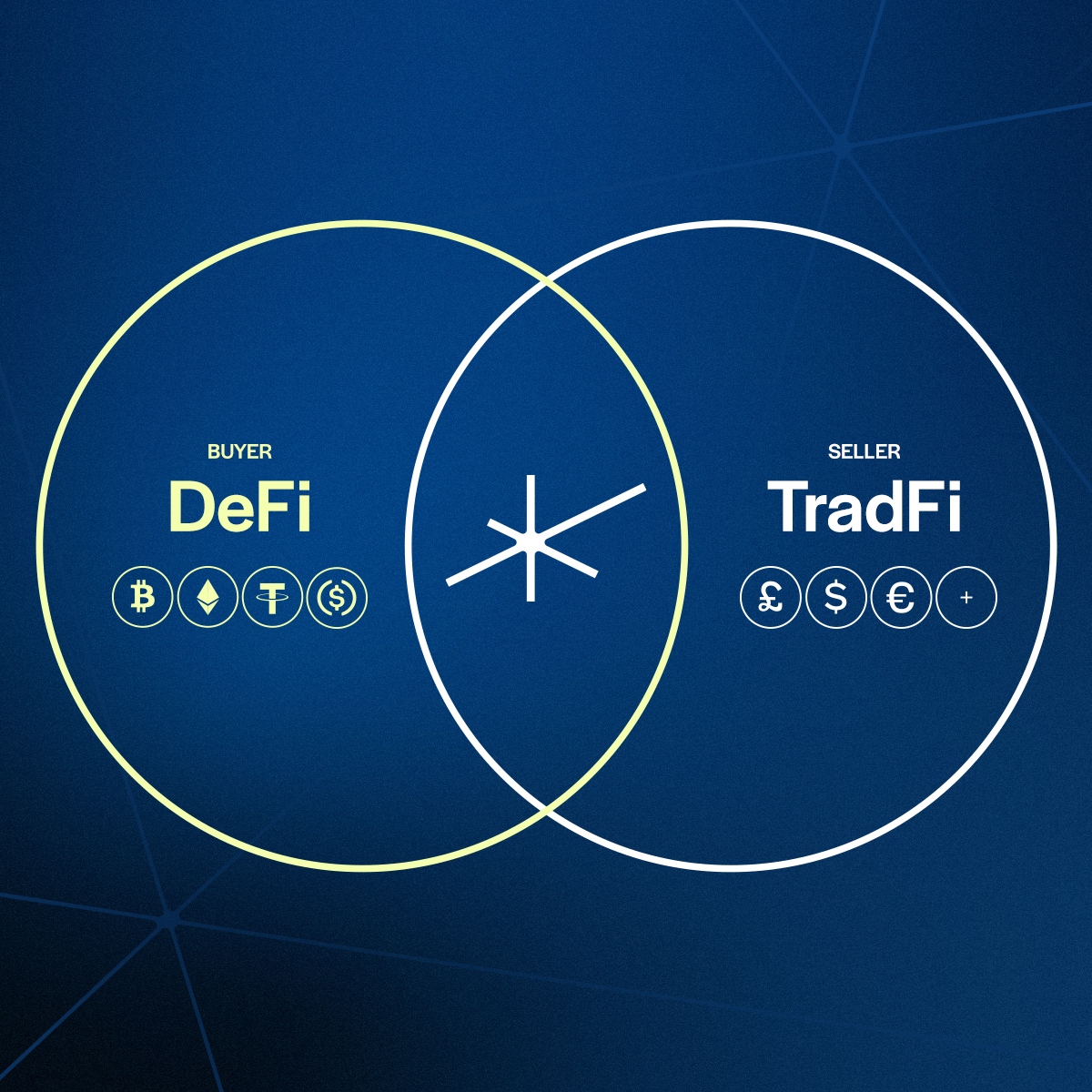

One of the main reasons businesses hesitate to accept cryptocurrency is the uncertainty of handling digital assets. With Trustlinq, however, you never need to deal with cryptocurrency directly. Here’s how it works:

- Crypto-to-Fiat Conversion: When a customer pays with cryptocurrency, Trustlinq seamlessly converts the cryptocurrency to fiat currency on their behalf. You receive the payment in one of 70+ supported currencies.

- Familiar Business Transactions: For you, the process remains entirely in fiat. The payment appears as a regular bank transfer in your preferred currency, making it as convenient and reliable as a traditional sale.

- Compliance and Security: Trustlinq operates as a regulated Swiss financial intermediary, adhering to rigorous compliance standards under Swiss Anti-Money Laundering (AML) regulations. Our dual-layer screening process ensures that every transaction meets compliance requirements, giving you peace of mind that your business is secure and compliant.

The Benefits of Working with Trustlinq

- Access a New Market with Minimal Effort: By accepting payments from Trustlinq, you instantly open your doors to a new customer base while maintaining business as usual.

- Receive Fiat in Your Currency: Trustlinq supports over 70 currencies, so you can receive payments in your preferred local currency, eliminating any foreign currency exchange issues.

- Seamless, Familiar Experience: Since Trustlinq handles all aspects of the crypto conversion and payment transfer, you don’t have to worry about adopting new processes. The crypto payment process is as seamless as any standard transaction.

- A Trusted, Regulated Partner: Trustlinq’s compliance with Swiss AML regulations adds a layer of security and legitimacy. Our operations are built on transparency and security, ensuring that both you and your customers are protected.

Join the Future of Finance Without the Complexity

With Trustlinq, businesses like yours can stay ahead of the curve by accepting cryptocurrency as a payment option via Trustlinq without changing a single thing about how you operate. You can receive payments from an entirely new customer base while benefiting from a process that feels familiar, secure, and compliant. There’s no need to worry about volatile crypto prices, and there’s no new currency risk—all payments are transferred to you in fiat.

At Trustlinq, we believe that digital assets can be a part of everyday commerce, and we’re here to make that vision a reality for you. By partnering with Trustlinq, you can give your business an edge in a rapidly evolving financial landscape, capturing a new audience without the hassle.

Ready to explore this new customer base? Contact us today to learn more about how Trustlinq can help your business grow. Ready to explore this new customer base? Contact us today to learn more about how Trustlinq can help your business grow.