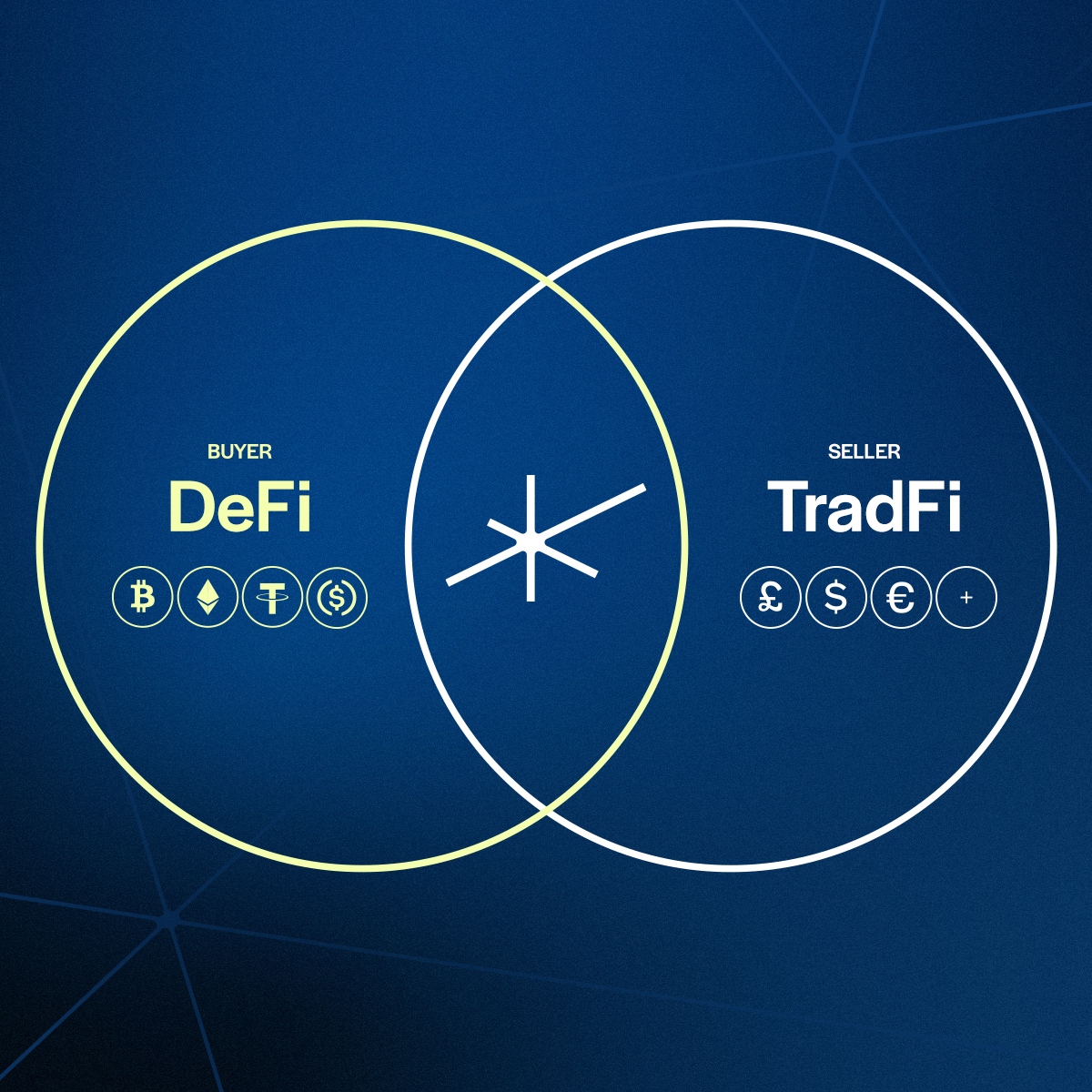

Cryptocurrency has rapidly become a significant asset for businesses, offering an alternative to traditional finance systems. However, many businesses struggle to use their cryptocurrency holdings for practical payments, whether it’s paying suppliers, managing payroll, or covering everyday expenses. TrustLinq bridges this gap with two core services tailored for businesses:

- Bank Transfers: Pay vendors, suppliers, and staff directly in their preferred fiat currency.

- Corporate Debit Card: Spend cryptocurrency conveniently for day-to-day expenses and online services wherever debit cards are accepted.

1. TrustLinq Bank Transfers: Simplify Payments to Vendors and Service Providers

For businesses, managing vendor payments, payroll, and other formal expenses often requires bank transfers. TrustLinq allows businesses to pay directly from their cryptocurrency holdings, delivering the payment in fiat currency to the recipient’s bank account. This eliminates the need for businesses to manage cumbersome conversions or navigate complicated processes.

Why Use TrustLinq for Bank Transfers?

- Global Reach: Pay recipients in over 70 fiat currencies, no matter where they’re located.

- Simplified Process: Just initiate the payment using your crypto holdings; TrustLinq handles the rest.

- Regulatory Compliance: Transactions are secure and meet the highest regulatory standards.

- Fast Processing: Most payments are completed within one business day, ensuring funds reach recipients promptly.

Examples of Bank Transfer Use Cases

- Payroll Payments:

Pay your staff, contractors, or freelancers in their local currency, whether they are based locally or internationally. TrustLinq ensures payments are delivered quickly and seamlessly. - Travel and Hospitality Expenses:

Cover costs for business trips, such as payments to travel agencies, airlines, and hotels. For example, pay for accommodation at international hotels or settle invoices with travel management companies. - Trade Shows and Events:

Settle fees for booth rentals, sponsorships, and registrations at trade shows or conferences globally. - Vendor and Supplier Payments:

Pay for goods and services from suppliers in various industries, such as manufacturing, logistics, and raw material providers. - Real Estate and Rentals:

Make bank transfers for office leases, coworking spaces, or business property rentals and the ability to set payments as periodic recurring payments.

By enabling bank transfers directly from cryptocurrency holdings, TrustLinq simplifies these essential business transactions, making it easier for companies to operate globally.

2. TrustLinq Corporate Debit Card: Spend Cryptocurrency Anywhere

For businesses that require flexibility in day-to-day spending, the TrustLinq corporate debit card is the perfect solution. Linked directly to your cryptocurrency holdings, this debit card allows businesses to pay for goods, services, and subscriptions anywhere debit cards are accepted.

Why Use the TrustLinq Corporate Debit Card?

- Versatile Spending: Use your crypto to pay for both online and in-person transactions.

- Global Acceptance: Make payments wherever major debit cards are accepted, whether for business tools or travel expenses.

- Convenience: Manage recurring expenses like subscriptions, advertising, and software licenses with ease.

- Real-Time Access: Spend your cryptocurrency without delays, unlocking its full potential for operational needs.

Examples of Debit Card Use Cases

- Subscriptions and SaaS Tools:

Many businesses rely on subscription-based services for their operations. With the TrustLinq corporate debit card, businesses can pay for:- Microsoft 365: For productivity and collaboration tools.

- Google Workspace: For cloud-based email and office applications.

- Dropbox: For secure file storage and sharing.

- Slack: For team communication and project management.

- Online Advertising:

Use the corporate debit card to pay for digital advertising campaigns, including:- Google Ads: Reach new customers through online search.

- Meta Ads: Promote your business on Facebook and Instagram.

- LinkedIn Ads: Target B2B audiences with precision.

- Software and Tools:

Pay for essential tools like:- Zoom: For video conferencing.

- Adobe Creative Cloud: For design and creative projects.

- HubSpot: For marketing and CRM management.

- Travel and Dining:

Book flights, pay for hotel stays, and dine out during business trips—all using the TrustLinq corporate debit card. - Operational Expenses:

Manage everyday purchases like office supplies, utilities, and telecommunications expenses.

The TrustLinq corporate debit card provides unmatched flexibility, allowing businesses to spend their cryptocurrency just like cash, wherever they need it most.

Key Benefits of TrustLinq for Businesses

- Two Payment Options: Businesses can choose between bank transfers for formal payments and a corporate debit card for everyday spending.

- Simplified Crypto Usage: Use cryptocurrency for business expenses without worrying about the technicalities—TrustLinq handles the rest.

- Global Reach: Pay in over 70 fiat currencies or use your debit card anywhere cards are accepted.

- Regulatory Compliance: All transactions meet strict regulatory standards for security and transparency.

- Cost Efficiency: Save on fees and eliminate the need for multiple financial platforms by consolidating payments through TrustLinq.

- Fast Processing: Most payments are completed within one business day, ensuring recipients receive funds quickly.

- Secure Transactions: Advanced encryption and security protocols protect every transaction.

- Improved Liquidity: Unlock the value of your cryptocurrency without needing to liquidate it in advance.

How TrustLinq Can Transform Your Business Operations

With TrustLinq, businesses can leverage their cryptocurrency holdings to cover essential expenses, improve financial flexibility, and streamline operations. By offering both bank transfer and debit card options, TrustLinq provides a comprehensive solution for businesses of all sizes.

When to Use Each Service:

- Bank Transfers: Ideal for payroll, vendor payments, trade shows, and formal expenses.

- Corporate Debit Card: Perfect for subscriptions, advertising, online purchases, and day-to-day spending.

Whether you’re paying for a supplier invoice or managing recurring subscriptions, TrustLinq ensures your cryptocurrency can be used easily and efficiently for any business need.

Getting Started with TrustLinq

- Sign Up: Create an account on TrustLinq’s platform.

- Onboard Your Business: Complete the onboarding process, including KYC/KYB verification.

- Start Spending: Use your crypto for bank transfers and debit card payments immediately.