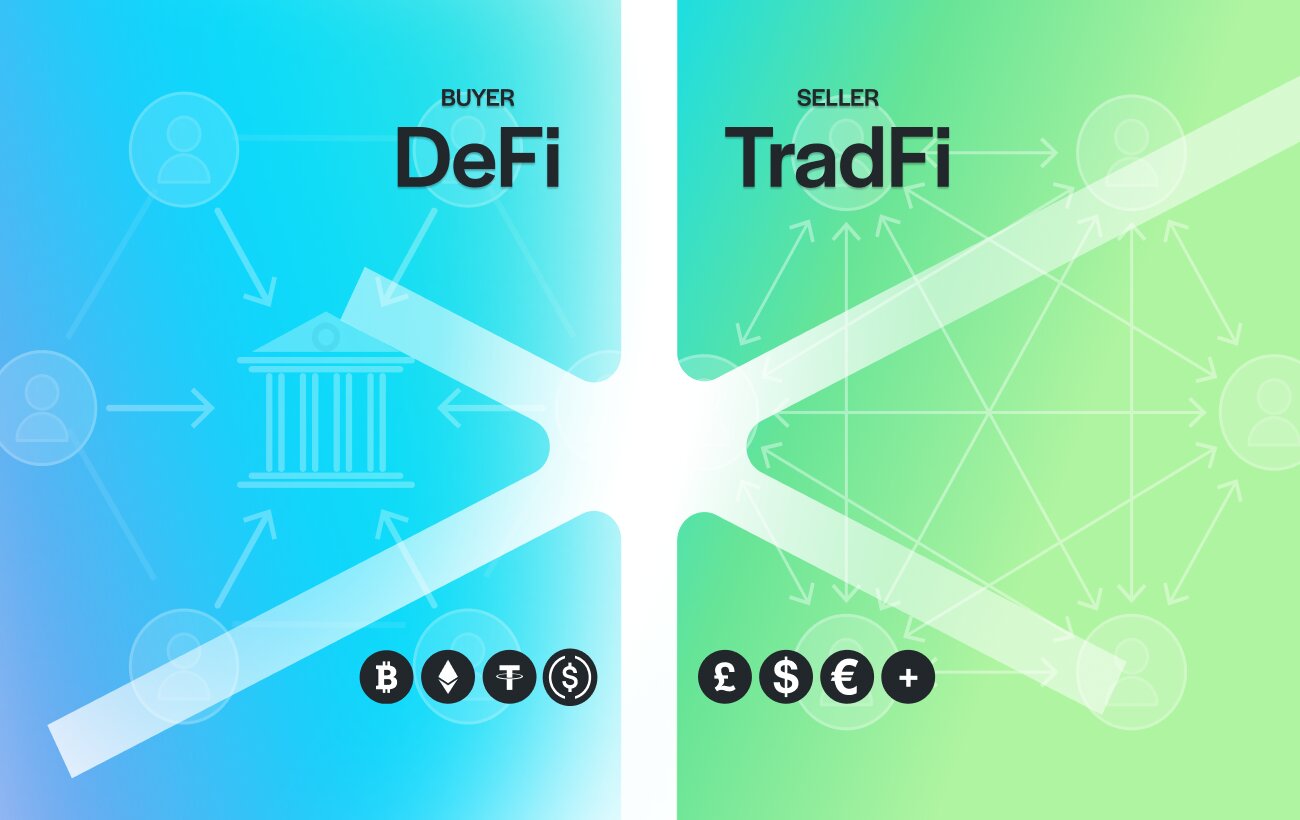

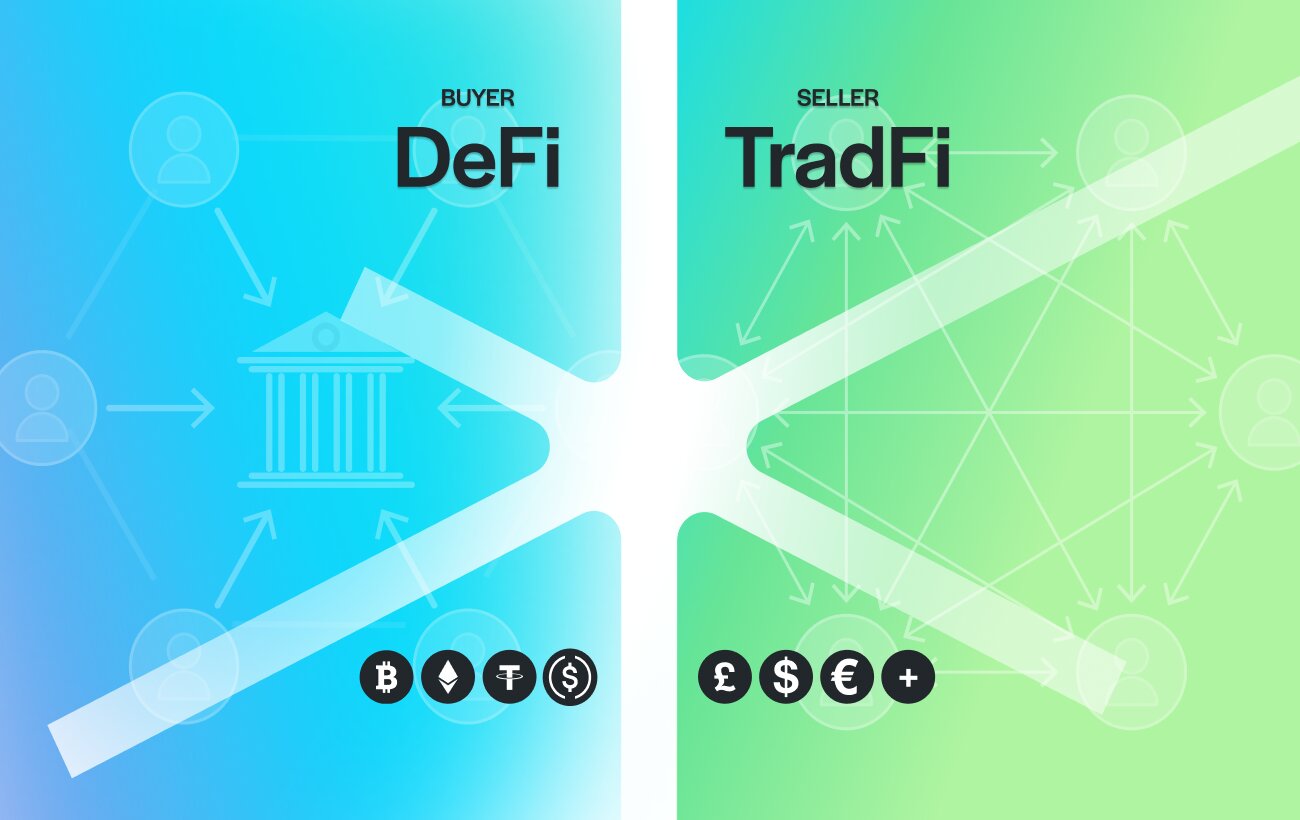

Many businesses are aware that a growing number of clients hold digital assets. However, most companies still hesitate to accept crypto payments. The reason is simple. They want to continue receiving fiat into their bank account, keep their accounting unchanged, and avoid dealing with cryptocurrency directly.

As a result, a large gap exists between client demand and business readiness. While millions of individuals and companies hold stablecoins, fewer than one percent of businesses offer a practical way to accept crypto while staying fully within traditional financial workflows.

This article explains how businesses can accept crypto and still get paid in fiat, why this has historically been difficult, and how modern payment infrastructure finally makes it possible without integration or operational change.

Why Businesses Avoid Accepting Crypto Payments

Most businesses operate entirely in fiat. Their accounting systems, tax reporting, payroll, and supplier payments are all built around bank transfers. Because of this, accepting crypto often feels incompatible with how companies already work.

In addition, many business owners associate crypto payments with technical integrations, custody risks, and exposure to price volatility. Even when client demand exists, these concerns create friction and delay adoption.

As a result, businesses face a difficult choice. Either they ignore crypto-paying clients or they introduce complexity into their operations. Until recently, there was no practical middle ground.

Why Clients Want to Pay With Crypto

At the same time, client behavior has changed. Stablecoins are now widely used for storing value and transferring funds globally. For international clients, stablecoins often provide faster settlement and fewer delays than traditional banking rails.

Because of this, many clients actively look for businesses that allow them to pay with crypto. Importantly, these clients are not asking businesses to hold digital assets. Instead, they want to use the assets they already hold while the business continues to receive fiat.

This disconnect between client preference and business requirements is one of the main barriers to broader crypto adoption.

The Real Requirement for Businesses: Fiat Settlement

For a business, accepting payment is not about the funding method. It is about settlement.

Invoices, contracts, and accounting systems all expect fiat. Even when a client prefers to pay with crypto, the business still needs a normal bank transfer to close the transaction properly.

Therefore, the key question is not whether businesses should accept crypto. The real question is whether they can accept crypto-funded payments while still receiving fiat in their bank account.

How Businesses Can Accept Crypto and Still Get Paid in Fiat

It is now possible for businesses to accept crypto and still get paid in fiat through a crypto-funded settlement model.

In this model, the client funds the payment using stablecoins from a self custodial wallet, making it possible to pay invoices with crypto without a bank account, while the business receives a standard bank transfer in fiat. At no point does the business hold or manage cryptocurrency.

The flow works as follows:

- The business issues its normal invoice in fiat

- The client funds the payment using crypto

- Compliance and settlement are handled by the payment platform

- The business receives fiat directly into its bank account

As a result, the business workflow remains unchanged. The only difference is that clients gain a new way to pay.

Why No Integration Is Required

Traditional crypto payment solutions rely on gateways, plugins, or merchant tools. These approaches require technical work and ongoing maintenance, which many businesses want to avoid.

By contrast, a crypto-funded settlement model shifts all digital asset activity to the client side. Because the client completes the crypto funding independently, the business does not need to integrate software, manage wallets, or modify internal systems.

Consequently, businesses can offer crypto-funded payments without touching cryptocurrency or changing how they operate.

No Crypto Exposure and No Operational Risk

Another major concern for businesses is exposure to crypto volatility and custody risk. Many companies are comfortable with fiat but prefer to stay away from managing digital assets.

With fiat settlement, the business never holds crypto. The amount received matches the invoice value in fiat, and settlement occurs through standard banking rails. This removes volatility risk and simplifies reconciliation.

Furthermore, because the crypto component is handled externally, businesses avoid the need to train staff or introduce new controls.

Why This Matters for International and High-Value Clients

Businesses that work with international clients or issue larger invoices benefit the most from this model. Cross-border payments often involve delays, intermediary banks, and unpredictable settlement times.

By allowing clients to fund payments with stablecoins while receiving fiat, businesses become easier to work with globally. This improves the client experience while preserving internal simplicity.

As a result, businesses gain access to a broader client base without expanding operational complexity.

The Role of Regulation and Compliance

Accepting crypto-funded payments requires proper compliance, especially when fiat settlement is involved. Payments must pass AML checks and align with regulatory standards.

TrustLinq operates under Swiss financial regulation and applies comprehensive compliance controls. This ensures that businesses can accept crypto-funded payments while maintaining regulatory confidence and operational clarity.

Importantly, compliance happens in the background. From the business perspective, the experience remains familiar and straightforward.

For additional context on how digital assets intersect with global payment infrastructure, the Bank for International Settlements provides ongoing research.

Why This Is Different From Traditional Crypto Gateways

Traditional crypto gateways and traditional crypto off-ramps are designed for merchants that want to accept and hold cryptocurrency, often requiring custody and integration.

By contrast, accepting crypto and still getting paid in fiat focuses on settlement rather than asset ownership. The business does not become a crypto merchant. It remains a fiat-based business that simply accepts a broader range of payment funding methods.

This distinction is critical for mainstream adoption.

What This Means for Business Adoption

Crypto adoption often focuses on trading volumes or wallet counts. However, real adoption happens when businesses can accept payments without changing how they work.

By enabling businesses to accept crypto while receiving fiat, payment infrastructure aligns with existing commercial reality. This removes one of the largest barriers to adoption and allows digital assets to function as a practical payment option.

Over time, this model supports a more inclusive and flexible global payment ecosystem.

Final Thoughts

Businesses do not need to choose between innovation and operational stability. It is now possible to accept crypto-funded payments while continuing to receive fiat in a bank account.

By removing integration requirements, custody concerns, and workflow changes, crypto becomes accessible to businesses that previously avoided it. This shift is essential for closing the gap between digital asset adoption and real-world usage. Businesses interested in offering crypto-funded payments while continuing to receive fiat can learn more through the TrustLinq Partner Program.

Yes. A business can accept crypto-funded payments while receiving fiat directly into its bank account. The client uses crypto, and the business settles in fiat.

No. In a crypto-funded settlement model, the client completes the crypto funding independently. The business does not need to integrate software or modify systems.

No. The business never touches crypto. It only receives a standard bank transfer in fiat.

Yes. This approach is especially useful for international and cross-border payments, where stablecoins offer faster and more predictable funding.

Yes. When handled through a regulated settlement provider, payments undergo compliance checks and settle through established banking rails.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.