Want to Spend Crypto in the Real World?

Use your crypto to pay rent, invoices, property, tuition, and large purchases.

Recipients receive a standard local bank transfer in 70+ currencies.

→ Spend crypto as an individual

→ Spend crypto for business payments

How to Buy Anything with Crypto: The 2026 Ultimate Guide

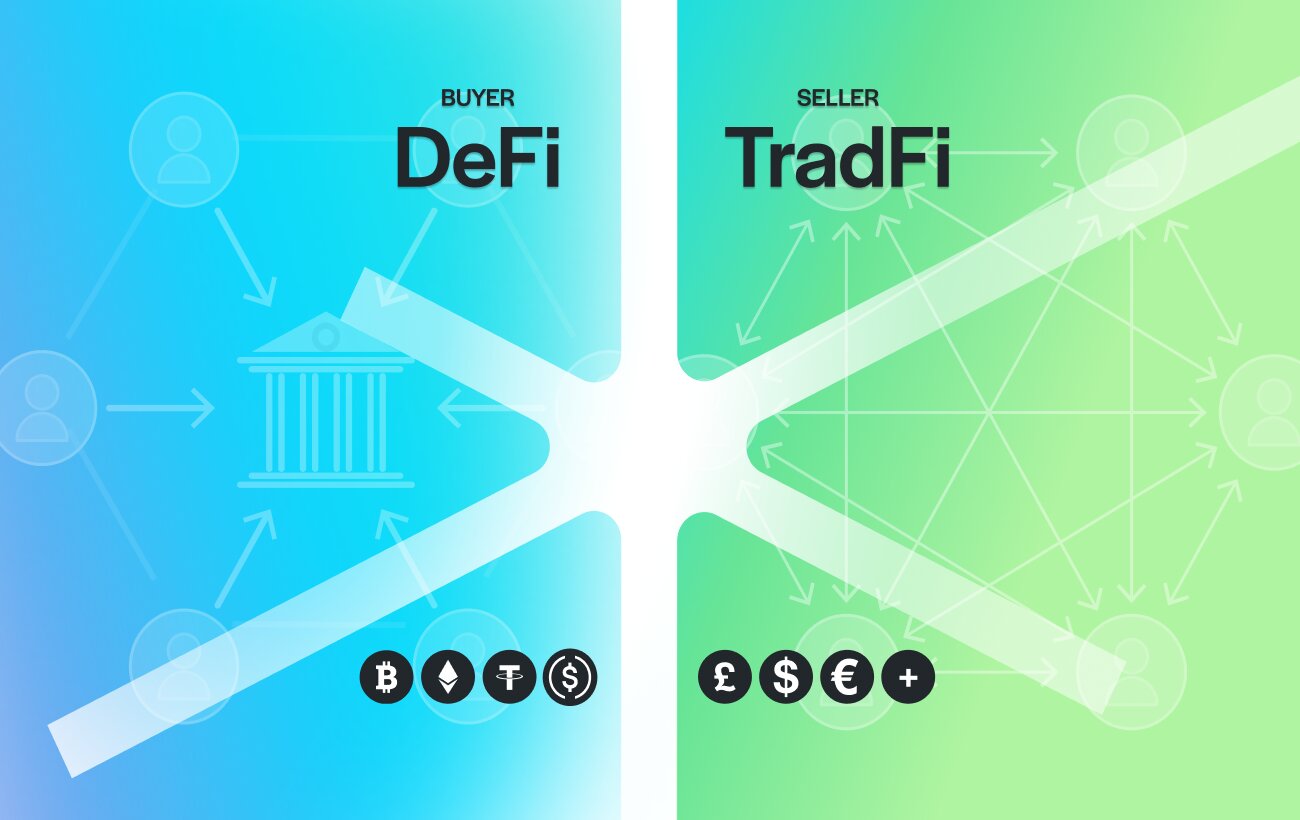

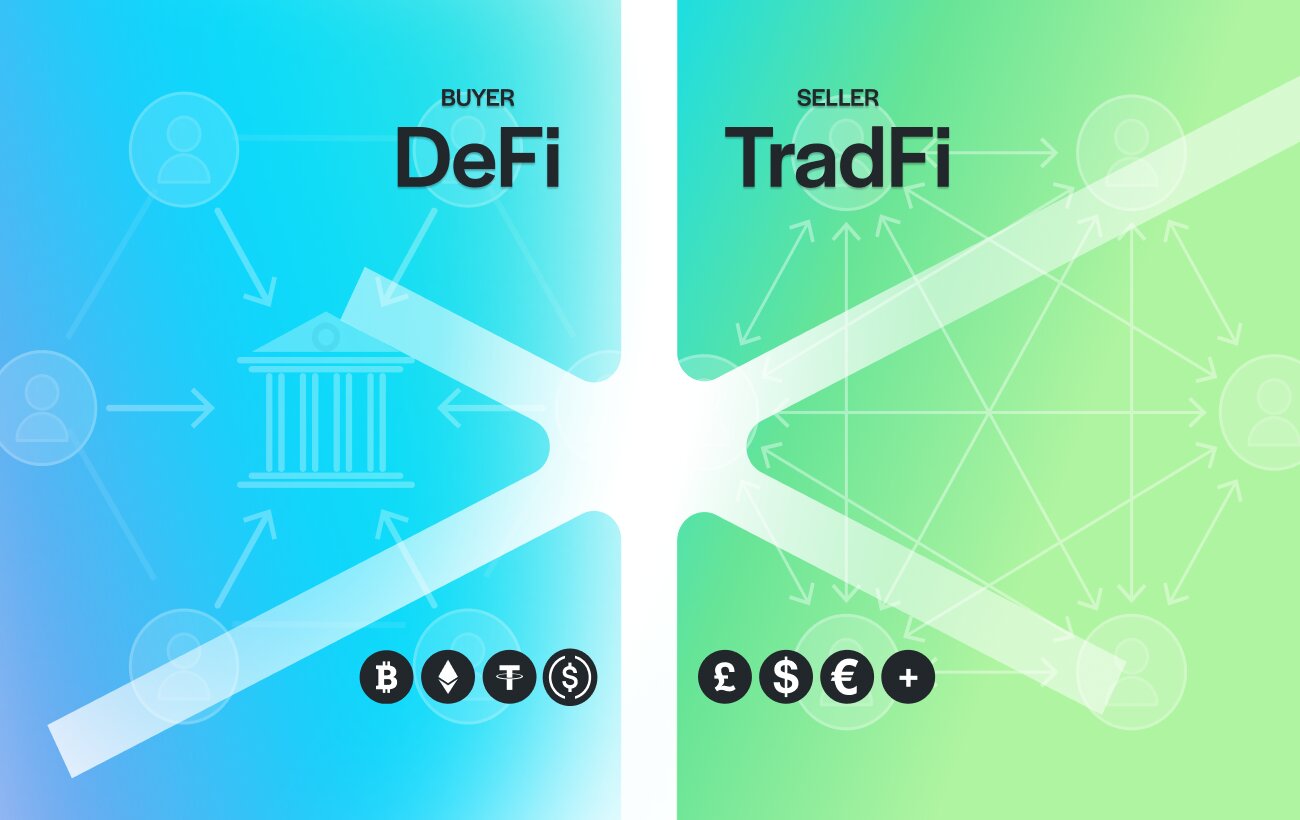

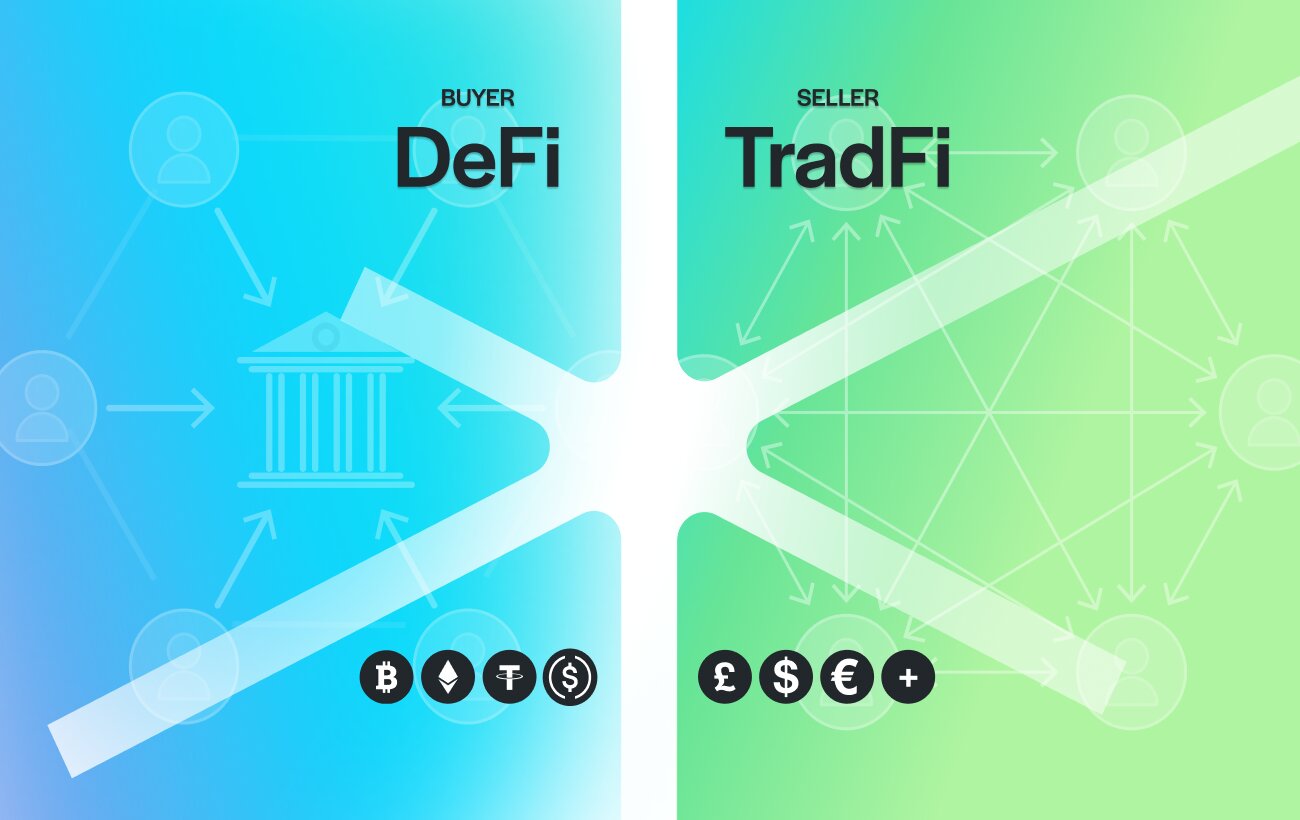

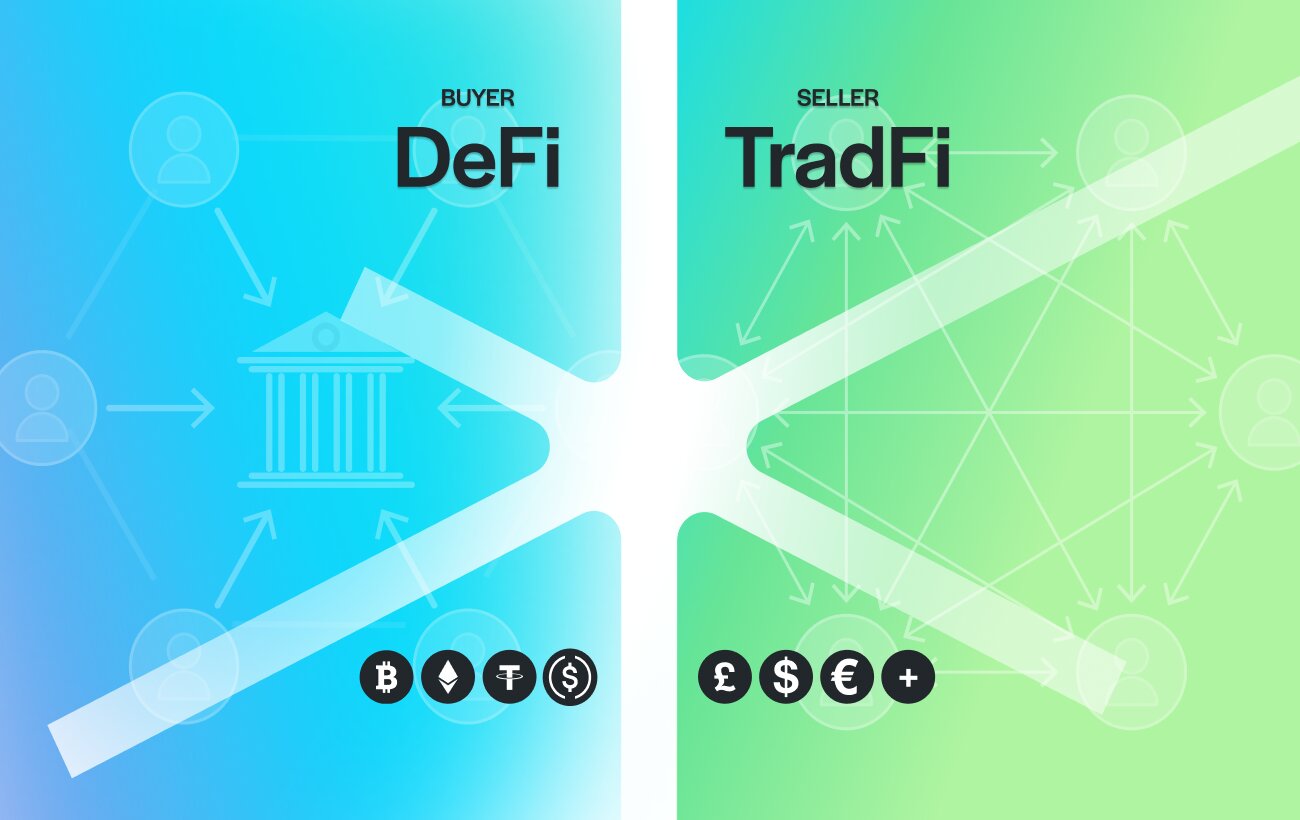

As we moved into 2026, the global cryptocurrency landscape has shifted from speculative holding to real-world utility. With over 600 million people now owning digital assets, the ultimate goal is no longer just tracking price charts. Instead, holders want to use their wealth in the physical world. However, a major challenge remains: while your wallet is ready, the world’s merchants often are not.

Most high-value sellers still operate on legacy banking infrastructure, such as IBANs and SWIFT codes. Consequently, you need a reliable method to bridge your digital assets with these traditional systems. This guide explains how to bypass these limitations and truly buy anything with crypto this year.

The 2026 Strategy: Search Bitcoin, Spend Stablecoins

Search data shows that “Buy with Bitcoin” remains the most common query for new users. Nevertheless, the most successful spenders in 2026 follow a distinct two-step approach. They treat Bitcoin as a primary store of value while executing actual purchases with stablecoins like USDC, USDT, or EURC.

This strategy allows you to lock in the exact price of an item. Specifically, you avoid the risk of BTC price swings during the hours required for a luxury purchase or property escrow. By using a regulated bridge service, you turn these digital assets into a standard bank wire that any business on earth can accept.

Top 8 High-Volume Categories for Crypto Spending

Based on current search trends, these are the primary ways holders utilize their crypto in 2026. Each category represents a sector where direct crypto payments are often refused, but bank transfers are always accepted.

- Buying Real Estate with Crypto: This is the most searched high-ticket category. Whether buying a penthouse in Dubai or a villa in Spain, the escrow process requires a compliant fiat transfer.

- Buying Luxury Cars with Crypto: From Ferraris to classic restorations, dealerships require formal bank wires for title registration and tax compliance.

- Luxury Watches and Jewelry: Authorized dealers for Rolex or Patek Philippe increasingly accept payments via crypto-to-fiat bridges.

- Private Aviation and Travel: Booking private jet charters is a top-three search trend for high-net-worth holders seeking speed and privacy.

- Paying Rent: As digital nomadism grows, thousands use crypto to settle monthly living expenses without opening local bank accounts.

- International University Tuition: Families are increasingly using digital assets to settle tuition invoices, bypassing the high fees of legacy cross-border banking.

- Legal and Professional Consulting: Paying for high-tier legal counsel or global consultants is now a standard use case for corporate treasuries.

- B2B Payments or International Contractors: Modern businesses use stablecoins to pay international contractors and settle invoices in seconds rather than days.

Ready to use crypto for real payments?

TrustLinq lets you fund payments with crypto while sellers receive a normal bank transfer.

No merchant crypto acceptance required.

→ Use crypto for personal payments

→ Use crypto for business payments

How to Bridge the “Merchant Gap”

he biggest hurdle to a crypto-native life is the “Merchant Gap”. This occurs when you have funds in your wallet, but the recipient only accepts a bank transfer. Furthermore, most traditional banks are still programmed to flag funds coming directly from crypto exchanges.

Therefore, thousands of users now choose to pay any bank account worldwide with crypto using a Swiss-regulated framework. This allows the recipient to receive a clean, compliant SEPA or SWIFT transfer. As a result, you maintain the security of your non-custodial wallet while satisfying the bank’s requirements.

Why Swiss Regulation is the 2026 Gold Standard

IIn 2026, trust is the most valuable currency in the blockchain space. Moving significant value for a home or car requires a platform that follows strict anti-money laundering (AML) protocols under Swiss regulation, which is considered the gold standard.

Because TrustLinq is a Swiss-regulated financial intermediary, we provide a reliable trust bridge. When we send a transfer, the recipient’s bank sees a regulated transaction from a Swiss financial entity. In addition, this significantly reduces the risk of compliance delays. It ensures that your luxury car or new home does not get stuck in banking limbo.

FAQs

Yes, it is legal in most global jurisdictions. However, success in 2026 depends on using a regulated intermediary to satisfy banking anti-money laundering (AML) protocols. When you pay any bank account worldwide with crypto, the transaction arrives as a standard fiat bank transfer. This meets the compliance requirements of the recipient’s bank while providing you with a legal proof-of-payment.

es, you do not need to find a crypto-friendly seller or dealership. As long as the business provides standard bank details (IBAN, SWIFT, or ACH), you can use TrustLinq to bridge the gap. Your crypto funds the transaction, but the recipient receives local fiat currency directly in their business bank account.

High-ticket markets like Buying Real Estate with Crypto and luxury cars require a fixed fiat purchase price. Because Bitcoin is volatile, its value can shift significantly during the contract phase. Stablecoins allow you to lock in the exact price instantly. Specifically, using USDC or USDT protects you from price drops that could result in a “short” payment to the seller.

While the crypto side of the transaction is nearly instant, the final bank delivery depends on local banking rails. Most TrustLinq transfers arrive within 24 hours via SEPA, Global ACH, or Faster Payments. This is significantly faster than traditional international wires, which can often take 3–5 business days to clear.

Turn Crypto Into Real World Payments

Use stablecoins to pay any bank account worldwide through a Swiss-regulated framework.

Spend crypto without waiting for merchant adoption.