Why Real-World Payments Break When You Use an Exchange

Crypto exchanges excel at what they were created to do. They help people buy, sell, and trade digital assets. They provide liquidity, pricing, and custody services that support active markets. That design focus explains why exchanges became the default starting point for many crypto holders. It also explains why they struggle when people try to use them for real-world payments.

Trading and payments may look similar because both move value, but they rely on very different structures. Trading systems prioritize speed, liquidity, and portfolio management. Payment systems prioritize clarity, settlement certainty, and predictable outcomes for recipients. When users rely on a trading tool to perform a settlement task, friction appears quickly.

What Exchanges Were Designed For

Exchanges focus on market activity. They enable users to enter and exit positions, manage exposure, and access liquidity efficiently. Their core design priorities include:

– fast execution and price discovery

– order books and trading pairs

– custodial balances linked to user accounts

– withdrawal rails designed to move funds out, not to explain payment purpose

These priorities serve trading extremely well. They do not align naturally with the requirements of paying rent, settling invoices, or delivering clean bank transfers that recipients accept without follow-up questions.

What Real-World Payments Require

A real-world payment demands certainty for the recipient. Most recipients expect local currency, a familiar bank transfer, and payment details that match their accounting workflow. Banks and payment networks also require structure. Practical payments depend on:

– clear economic purpose

– stable beneficiary details

– local settlement whenever possible

– predictable delivery timelines

– transaction data that fits standard banking logic

This mismatch explains why many crypto holders trade smoothly but face problems when they try to pay people who operate entirely in the fiat economy.

Why Payments Fail More Often Through Exchange Routes

When users route payments through exchanges, the system treats those movements as withdrawals rather than structured settlement. That distinction matters. A withdrawal focuses on moving funds away from a platform. A payment focuses on delivering funds cleanly to a recipient with context.

International routing creates another major issue. Many exchange withdrawals rely on international wires that pass through multiple correspondent banks. Each intermediary applies its own risk policies and review standards. This process increases the chance of delays, follow-up questions, or mid-route blocks.

Context also plays a critical role. Recipient banks cannot see the sender’s trading history or intent. They only see an inbound transfer that may not match typical account behavior. This lack of clarity often triggers reviews, even for legitimate users. If you want a deeper explanation, read why banks freeze crypto transfers.

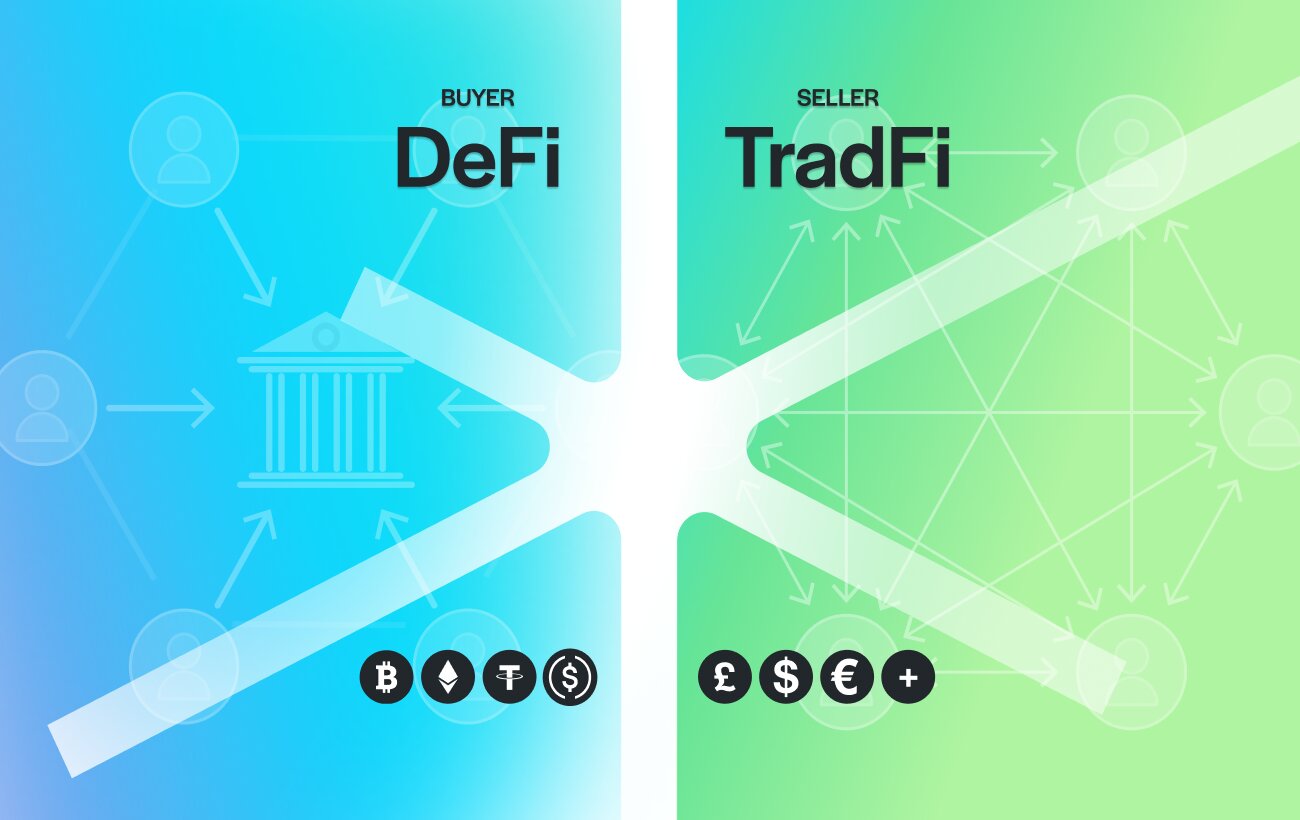

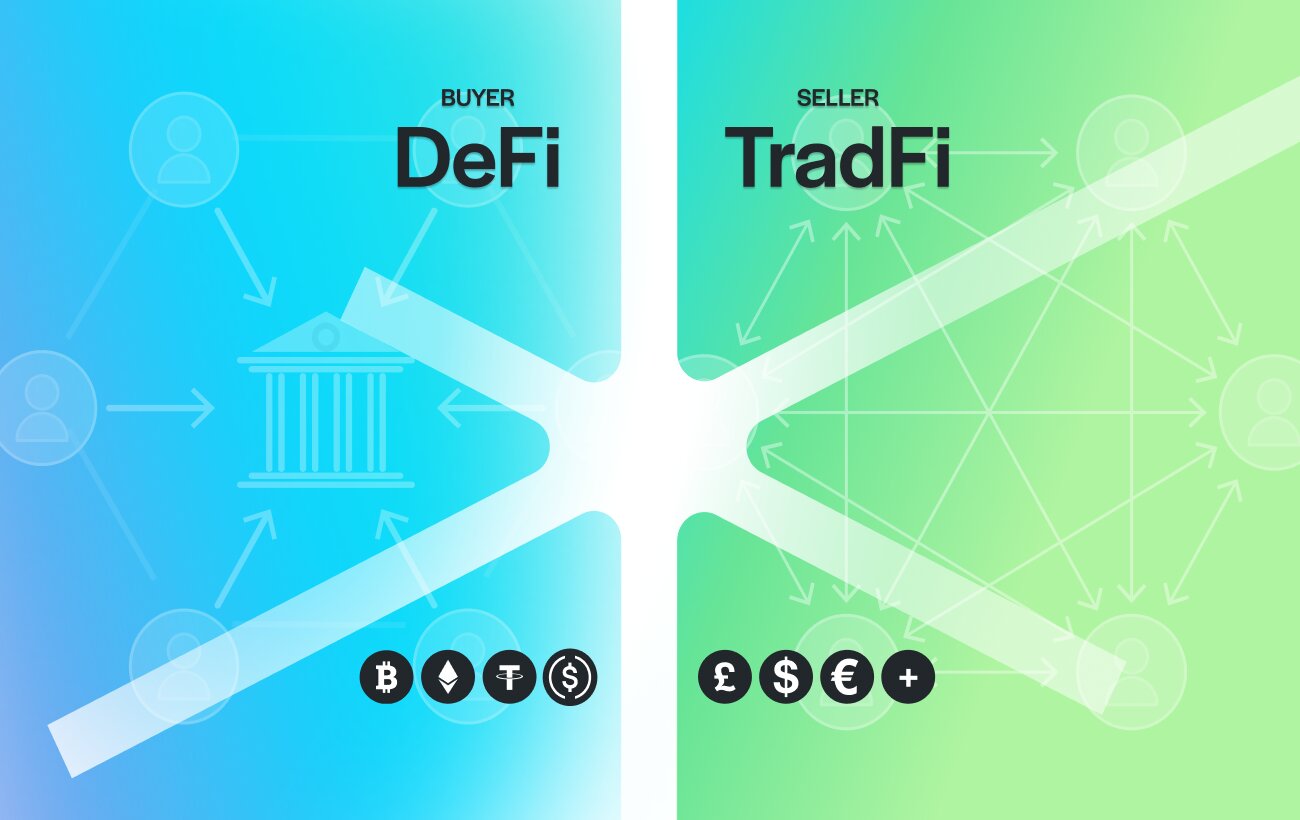

The Missing Layer: Crypto-Funded Fiat Settlement

The market needed a payment-native layer designed specifically for settlement rather than trading. This gap led to the emergence of a new category. Instead of off-ramping into a personal bank account and paying from there, this model enables users to fund payments with stablecoins while recipients receive local fiat directly. This approach is known as crypto-funded fiat settlement.

This structure shifts focus to the beneficiary, the payment purpose, and the settlement rail. It avoids treating payments as a side effect of withdrawing from a trading platform. It also reflects the principle that users should not off-ramp to themselves just to pay someone else. That concept appears in self-custodial crypto to third-party fiat settlement.

Why Local Settlement Matters More Than Most People Think

The number of intermediaries involved in a transfer strongly affects reliability. Each additional bank introduces another policy layer and review process. Local settlement reduces this exposure. When payments settle through domestic rails, receiving banks process them like standard local transfers. The mechanics behind these flows are explained in crypto to fiat bank transfers.

Use the Right Tool for the Job

Exchanges serve trading extremely well. They provide powerful tools for market participation and portfolio management. Payments require a different foundation. Payment systems prioritize settlement clarity, predictable delivery, and recipient experience. As crypto adoption moves beyond trading toward real-world use, payment-native infrastructure becomes essential. When users rely on tools designed for settlement, payments stop feeling improvised and start behaving like normal financial transactions.

FAQs

Exchanges can move funds, but they are designed for trading and withdrawals, not for delivering purpose-built payments with clear settlement context for recipients.

Withdrawals often lack payment context and may route through international wires and correspondent banks. This increases the chance of additional screening or delays.

It is a payment structure where the sender funds a transaction with crypto, while the recipient receives local fiat directly through standard bank rails.

Not necessarily. Payment-native infrastructure can settle directly to the beneficiary, reducing exposure created by routing funds through personal accounts.

Local settlement reduces intermediaries and improves predictability. Fewer correspondent banks means fewer policy differences that can interrupt a transfer.

Turn Crypto Into Real World Payments

Use stablecoins to pay any bank account worldwide through a Swiss-regulated framework.

Spend crypto without waiting for merchant adoption.

→ Start spending crypto as individual

→ Use crypto for your business