How to Transfer Crypto Directly to a Bank Account Without Using an Exchange

Using crypto in the real world is no longer about speculation. More individuals and businesses now hold digital assets as part of their everyday finances. However, when it comes time to move that value into the traditional banking system, the process often feels outdated and unnecessarily complex.

Most users are still forced to send crypto to an exchange, sell it for fiat, withdraw to a personal bank account, wait several days, and then make a separate payment to the final recipient. Each step adds friction, fees, and compliance risk.

This is why searches for “crypto to bank account without an exchange” and “crypto to fiat direct transfer” continue to rise. Users want a simpler and safer way to move value from a wallet into any bank account.

This article explains how crypto can fund a bank transfer directly, without using an exchange, without off-ramping to your own bank account first, and without requiring the recipient to accept crypto.

Why People Want Crypto to Bank Transfers Without Exchanges

Centralized exchanges were built for trading, not for settlement.

For users who already hold crypto, exchanges introduce unnecessary complexity:

– short withdrawal limits

– compliance reviews and account freezes

– multi-day settlement delays

– additional conversion fees

– increased scrutiny from banks

At the same time, almost all real-world payments remain fiat-based. Rent, invoices, tuition, healthcare, and professional services still require bank transfers.

The issue is not spending crypto.

The issue is paying fiat obligations efficiently.

What “Crypto to Bank Account Without an Exchange” Really Means

This term does not imply avoiding regulation or bypassing compliance. It refers specifically to avoiding exchange-based workflows.

A crypto to any bank account transfer without an exchange means:

– crypto is the funding source

– fiat is the settlement currency

– no exchange account is required

– no personal off-ramp is needed

– the recipient receives a standard bank transfer

From the recipient’s perspective, the payment looks exactly like any other domestic or international bank transfer.

Why the Traditional Exchange Model No Longer Works

The standard exchange-based flow looks like this:

– send crypto to an exchange

– sell crypto for fiat

– withdraw fiat to your own bank account

– send a second transfer to the final recipient

This model fails at scale because:

– it creates multiple compliance touchpoints

– it exposes personal bank accounts to crypto-related risk

– it introduces delays at every step

– it was never designed for operational or recurring payments

Many users now actively search for alternatives to this approach.

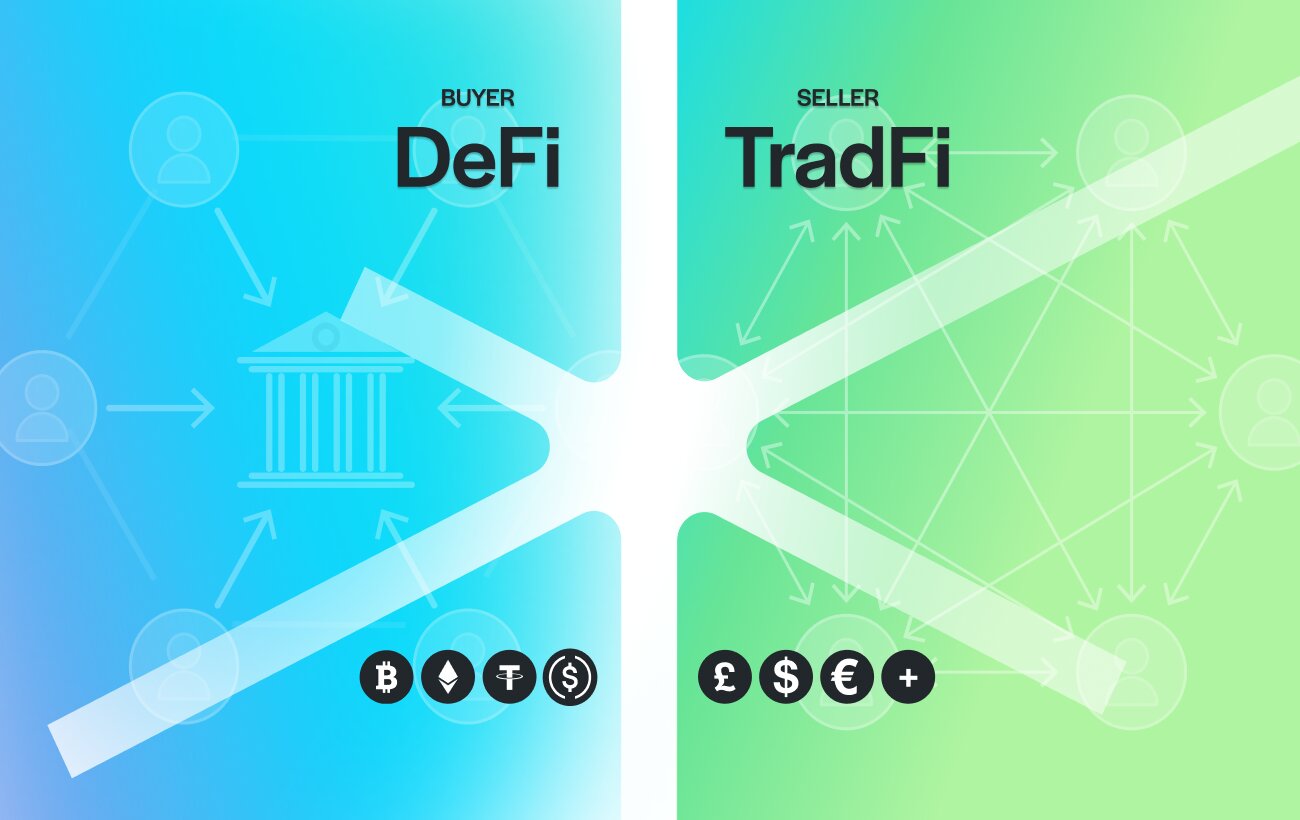

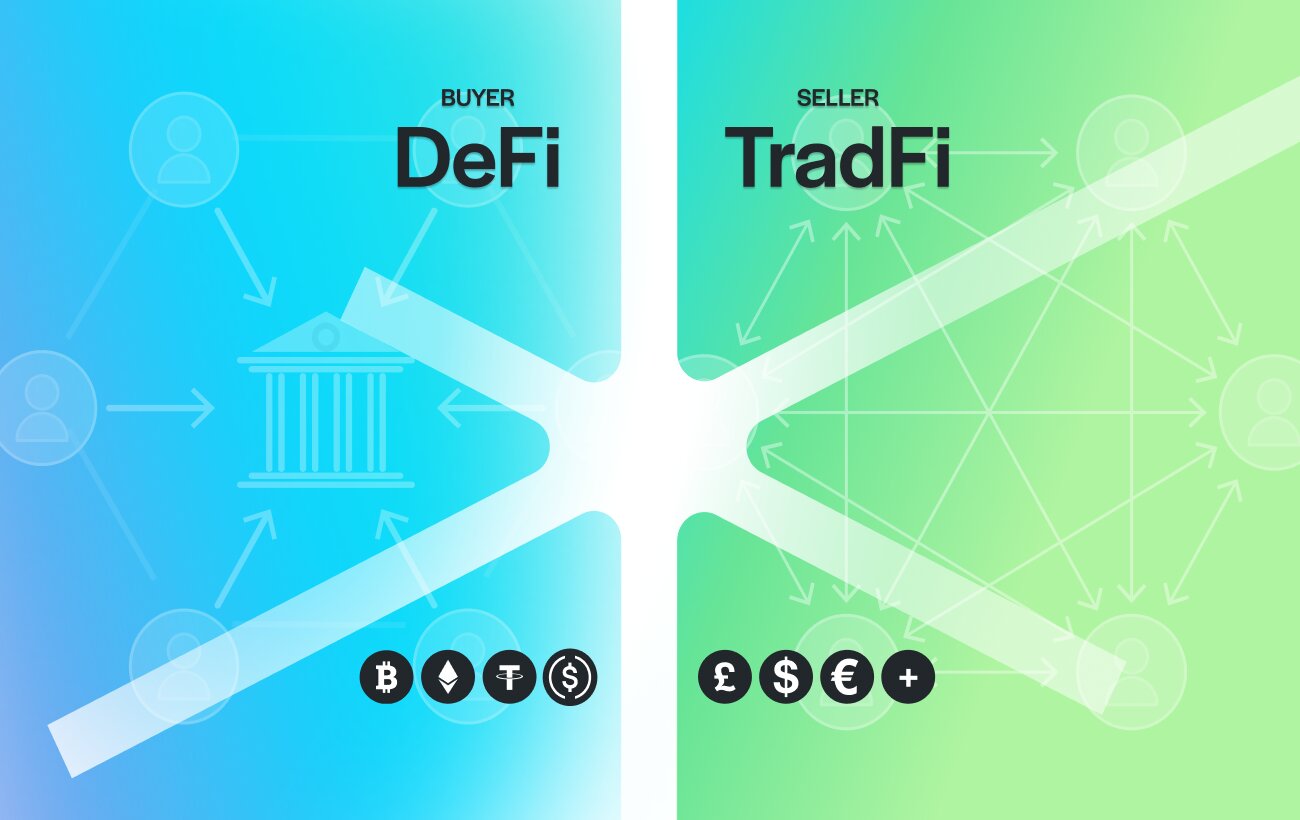

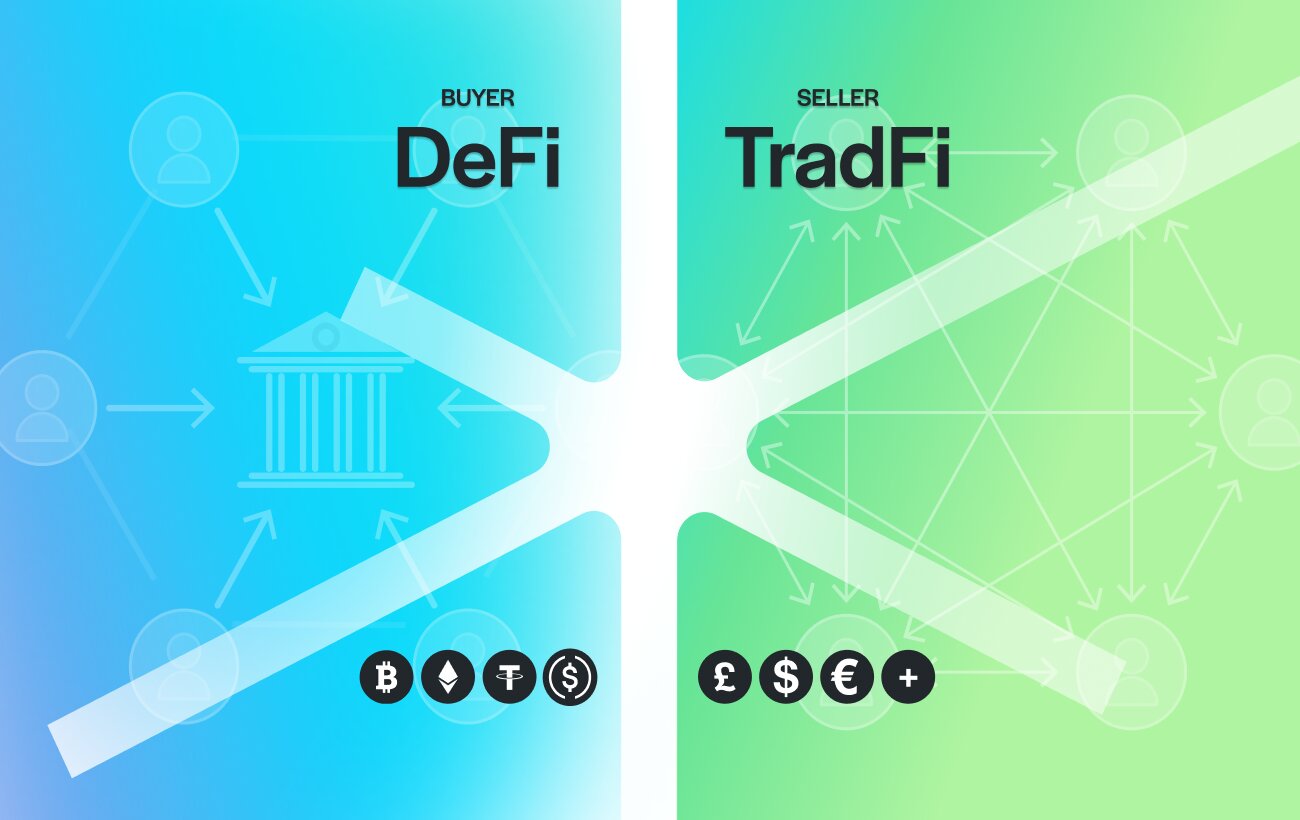

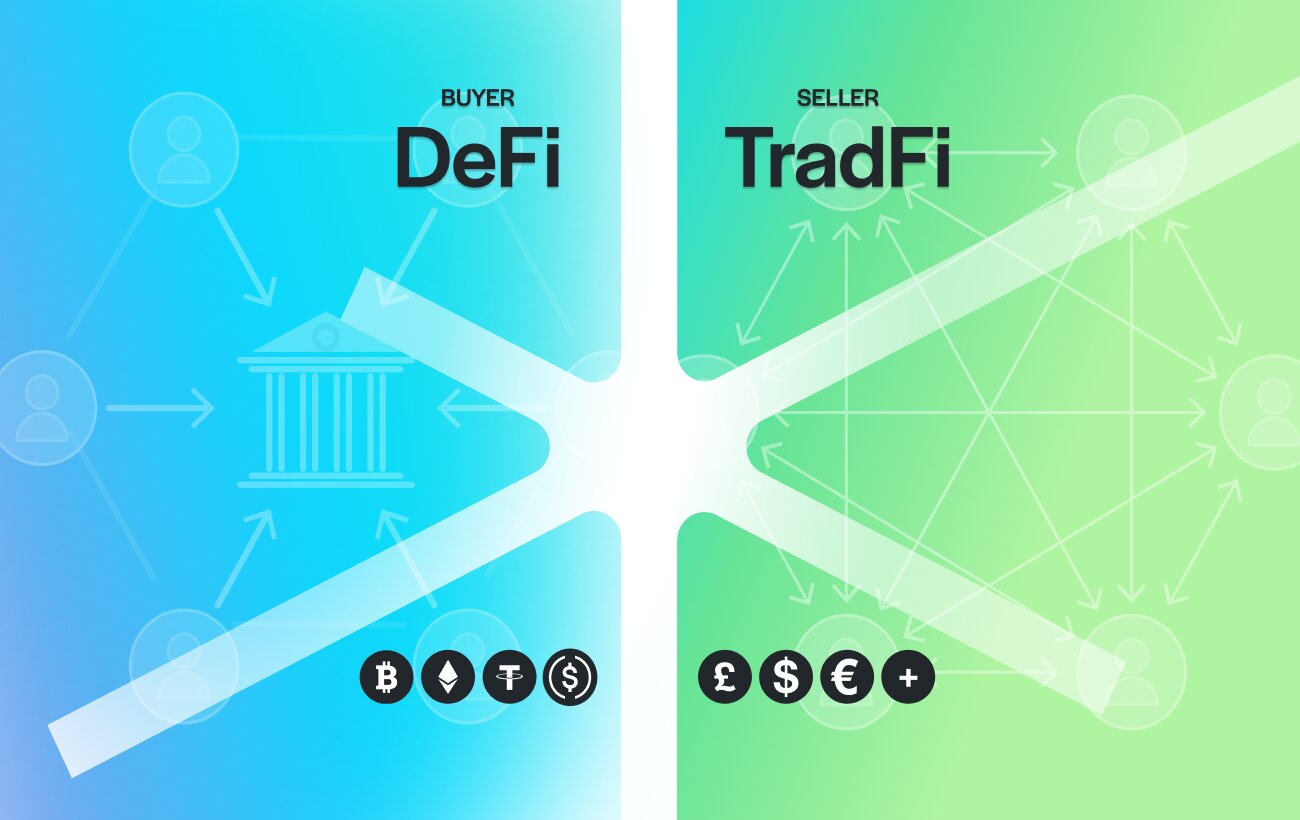

The Direct Crypto-to-Bank Settlement Model

A direct crypto-to-bank settlement model removes unnecessary steps.

Instead of off-ramping to yourself, crypto directly funds a regulated bank transfer to the final recipient. The transaction settles once, through traditional banking rails.

This approach builds on the settlement-layer concept explained in crypto to fiat bank transfers and shifts the focus away from exchange-based trading.

How a Crypto to Bank Transfer Without an Exchange Works

In practice, the process is straightforward:

– you hold crypto in a self-custodial wallet with TrustLinq

– you initiate a payment using standard bank details

– crypto funds the transaction

– the recipient receives fiat in their bank account

The bank only sees a normal SEPA, Faster Payment, ACH or Global ACH transfer (international but executed through local rails). The recipient never interacts with crypto.

This is the same principle described in self-custodial settlement, applied to everyday bank payments.

Why Stablecoins Are Typically Used

While volatile assets can technically be used as a funding source, most users prefer stablecoins.

Stablecoins offer:

– price stability

– predictable settlement amounts

– simpler accounting

– reduced market risk during transfer

This is why stablecoins are central to many of the workflows described in Buy Anything with Crypto in 2026 and global crypto-funded payments.

Is This Legal and Compliant?

Yes, when executed correctly.

The key distinction is that the recipient receives fiat, not crypto.

From a regulatory perspective:

– the settlement happens in fiat

– the transfer runs through regulated banking rails

– AML and transaction screening apply as usual

– the payment documentation mirrors traditional bank transfers

This model fits existing legal, tax, and accounting frameworks and avoids many of the risks associated with exchange withdrawals.

Common Use Cases for Exchange-Free Crypto to Bank Transfers

This settlement model is commonly used for:

– paying invoices when a bank account is unavailable

– paying rent or recurring obligations

– settling supplier bills globally

– spending crypto without exposing personal bank accounts

– reducing bank de-risking linked to exchanges

Several of these scenarios are explored further in spending crypto without banking access, safer alternatives to off-ramps and how to buy anything with crypto.

Why This Is Different From Traditional Off-Ramps

Traditional off-ramps move fiat into your own bank account first.

Direct settlement skips that step entirely.

Advantages include:

– fewer compliance touchpoints

– lower risk of frozen accounts

– faster settlement

– cleaner audit trails

– less operational complexity

For users who already know where the money needs to go, this approach is simply more efficient.

Final Thoughts

Crypto adoption does not require replacing the fiat system. It requires bridging into it intelligently.

A crypto to bank account transfer without an exchange represents a practical evolution of crypto utility. Crypto remains the funding layer, while fiat remains the settlement layer.

This approach avoids the limitations of exchanges and aligns crypto with how the real world already operates, in fiat.

For most users, this is not a workaround.

It is the natural next step.

FAQs

Yes. Crypto can fund a payment that settles as fiat directly into any bank account.

No. Exchange-free settlement allows crypto to fund a bank transfer without selling on an exchange first.

No. Off-ramping sends fiat to your own bank account. Direct settlement sends fiat to the final recipient.

No. The recipient receives a standard bank transfer.

In many cases, yes. It reduces exposure to exchange withdrawals and personal bank scrutiny.

Turn Crypto Into Real World Payments

Use stablecoins to pay any bank account worldwide through a Swiss-regulated framework.

Spend crypto without waiting for merchant adoption.

→ Start spending crypto as individual

→ Use crypto for your business