Direct Answer: The most efficient way to pay international contractors with crypto in 2026 is through a self custodial settlement bridge. This process allows your business to fund payroll using stablecoins like USDC, USDT or EURC while the contractor receives a standard local bank transfer in their own currency. This eliminates the need for the recipient to manage a crypto wallet or deal with exchange price changes.

Global business in 2026 moves faster than the traditional banking system can handle. While the SWIFT network still takes three to five business days to settle, crypto allows for near instant transfers. However, a significant gap remains: most contractors still need fiat currency for their local expenses like rent and taxes.

The Problem with Direct Crypto Transfers

Sending Bitcoin or Ethereum directly to a contractor’s wallet often creates more problems than it solves. Many traditional banks are still hesitant to accept transfers originating from retail crypto exchanges, which can lead to frozen accounts for your team. Additionally, the technical burden of managing private keys and the risk of price volatility during the transfer process can make freelancers reluctant to accept digital assets.

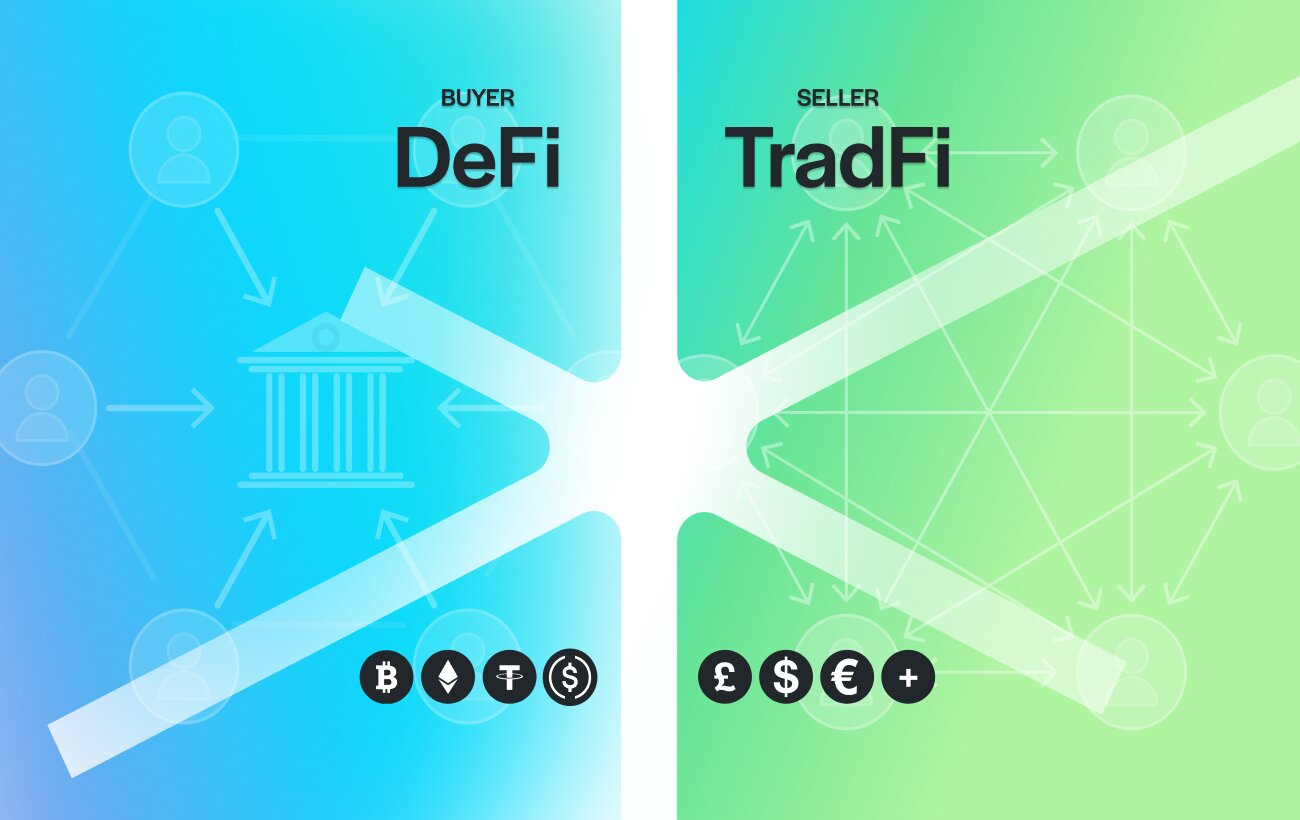

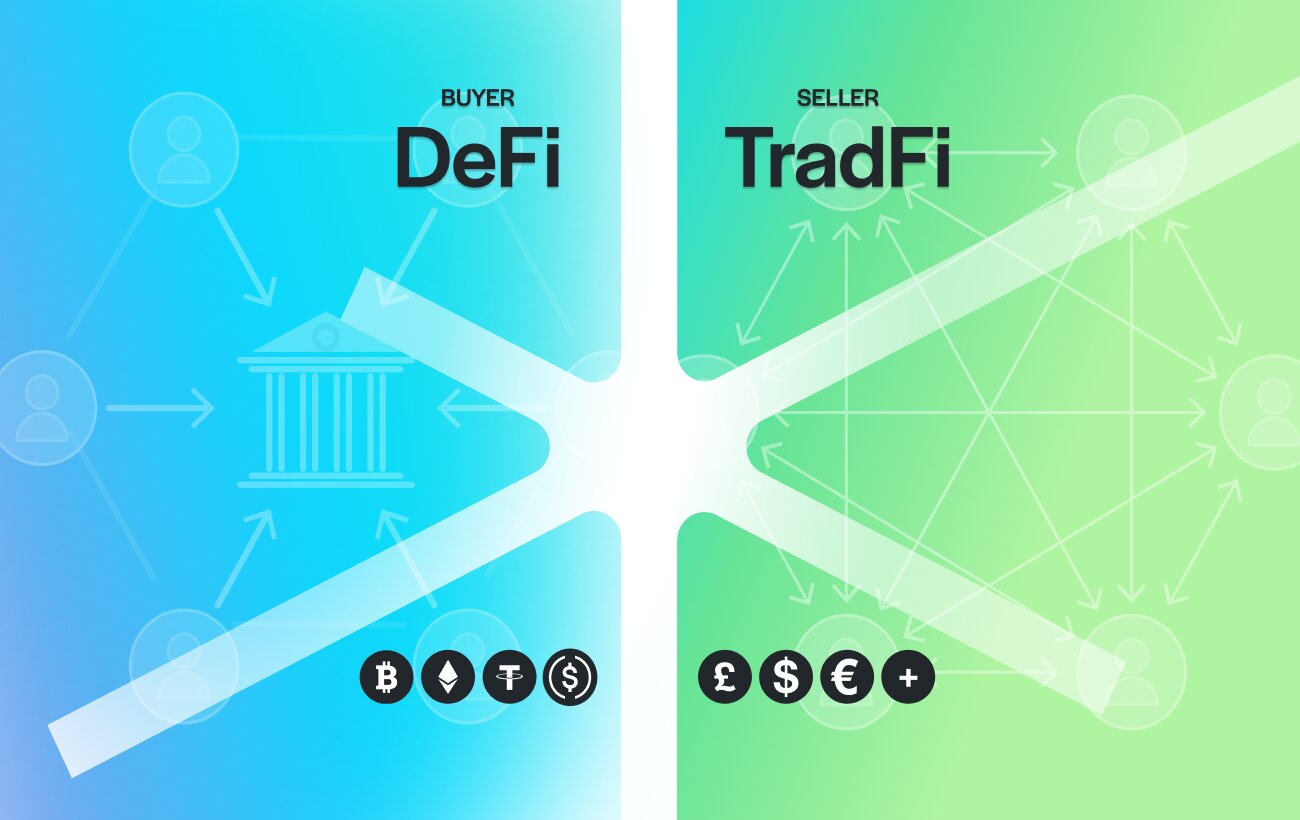

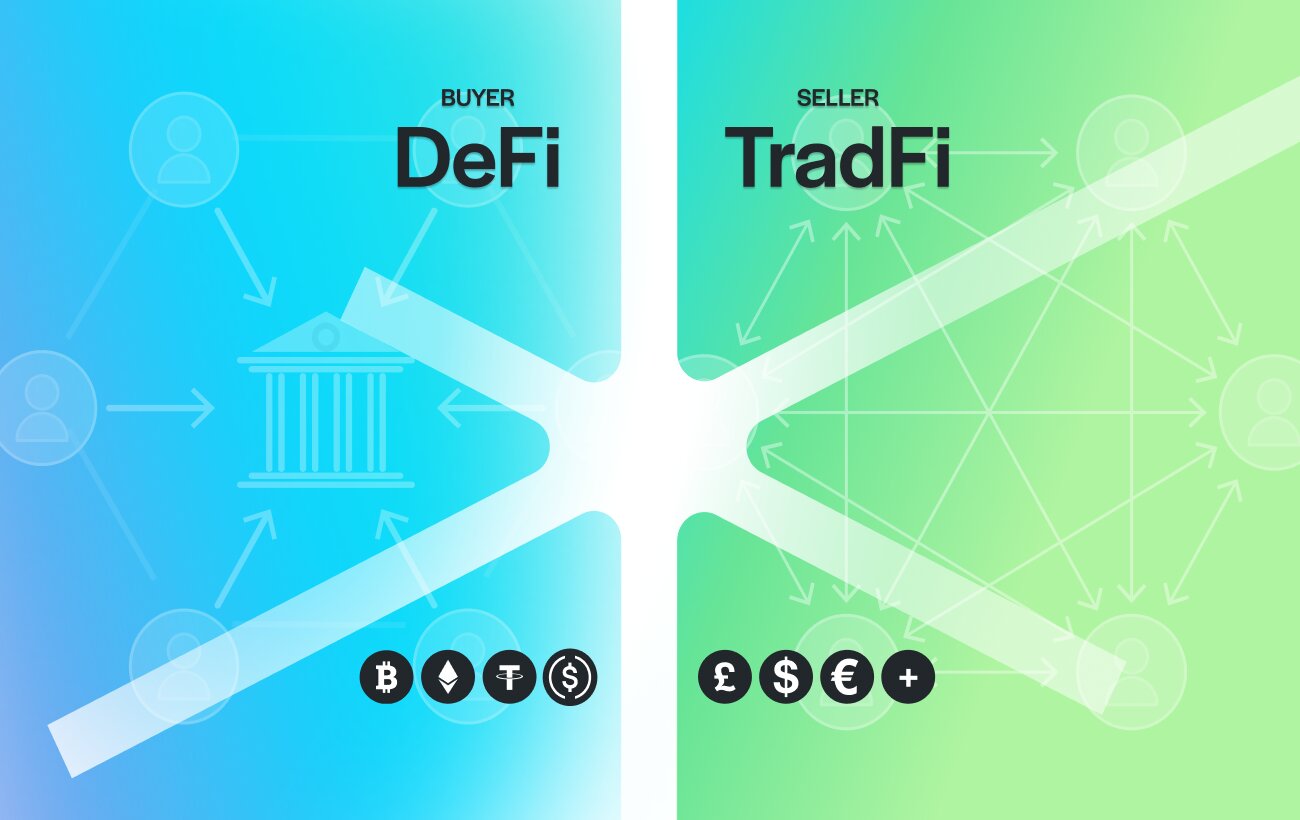

The Solution: Funding with Crypto, Settling in Fiat

The modern approach involves using a bridge. This allows your company to leverage the speed and borderless nature of blockchain while providing your contractors with the standard fiat bank transfers they expect.

Choosing the Right Asset: USDC vs. USDT

For business payroll, stablecoins are the industry standard. They provide the predictability of the US dollar with the efficiency of the blockchain.

- USDC (Circle): Best for Western startups and SMEs. It offers high institutional trust and follows strict US regulated reserve standards.

- USDT (Tether): Best for emerging market payments. It offers the highest global liquidity and moves quickly across almost every major blockchain.

Supported Networks and Assets

To ensure maximum flexibility and low transaction costs, our bridge supports the most stable and widely used digital assets:

- USDC and EURC: Highly regulated stablecoins for USD and Euro settlement.

- USDT (ERC20 & TRC20): Choose between the high liquidity of Ethereum or the ultra-low fees of the TRON network.

2026 Compliance and Tax Requirements

Staying compliant while paying international contractors in crypto is simpler than most CFOs realize, provided you maintain a clear paper trail. Under the OECD’s Crypto Asset Reporting Framework (CARF), transparency is now a global standard.

- Contractual Terms: Ensure your service agreement specifies the payment amount in a stable fiat currency to avoid disputes over crypto price changes.

- Tax Documentation: You must still collect the appropriate forms, such as the W-8BEN for individuals or W-8BEN-E for entities, to certify their tax status.

- Audit Trail: By using a bridge like TrustLinq, you create a verifiable record where the funding source (crypto) is clearly linked to the final fiat disbursement (bank transfer).

Why TrustLinq is the Preferred Bridge for 2026

TrustLinq was built to solve the specific friction between decentralized finance and traditional banking. It allows for a self custodial to third party fiat settlement. This means your funds are never sitting in a central company’s account; you send the crypto from your own wallet, and TrustLinq ensures it arrives as a regulated bank transfer in the contractor’s account.

This model is particularly valuable for companies that want to remain crypto native while staying fully compatible with the legacy financial system. The contractor never has to touch crypto, and the company never has to worry about the recipient’s bank rejecting a digital asset.

FAQs

Yes, it is legal in most jurisdictions. When using a bridge, you are technically funding the payment with crypto while the contractor receives fiat. This ensures the transaction remains compliant with local labor laws and banking regulations.

You should treat the payment as a standard business expense. Record the fiat value of the crypto at the time of the transaction for your accounting records. Always collect the necessary tax forms (like W-8BEN) from your contractors regardless of the payment method.

Because TrustLinq settles the payment as a standard local bank transfer (such as SEPA or ACH), the recipient’s bank sees a regular fiat transaction. This eliminates the risk of “crypto-related” account freezes that often happen with direct wallet-to-bank transfers.

Stablecoins like USDC or USDT are generally best for payroll because they are pegged to the US Dollar. This protects both the business and the contractor from the volatility of assets like Bitcoin or Ethereum.

Summary of Benefits

By shifting to a crypto funded payroll model, your business can reduce international transfer fees by up to 80% compared to traditional wire transfers. You also eliminate the “middleman” delays that often frustrate remote teams in different time zones.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.