Holding crypto is no longer the hard part. Using it for real payments still is.

Most businesses and individuals hold stablecoins like USDT, USDC, or EURC because they move fast and work globally. However, when it comes time to pay an invoice, settle a supplier, or cover a real-world expense, they hit the same wall.

The recipient wants fiat.

In most cases, they rely on a traditional bank account.

As a result, crypto is not accepted on their side.

For this reason, many people search for ways to spend crypto anywhere.

Why spending crypto is still difficult today

Crypto adoption has grown, but merchant acceptance has not.

In practice, most payment options fall into one of three categories.

Crypto cards

These depend on card networks, local availability, and strict usage limits. Coverage is fragmented and often unreliable for business payments.

Merchant crypto acceptance

This assumes the recipient wants crypto, which is rarely the case for rent, suppliers, salaries, or service providers.

Traditional off-ramps

These require a bank account in your name, introduce friction, and are designed for cashing out rather than paying third parties.

As a result, crypto holders are left holding value they cannot easily use. A good comparison can be found here.

What “spend crypto anywhere” actually means

For crypto holders, however, spending crypto anywhere does not mean forcing merchants to accept crypto.

It means something simpler and more practical.

You pay using crypto.

The recipient receives fiat.

No workflow changes on their side.

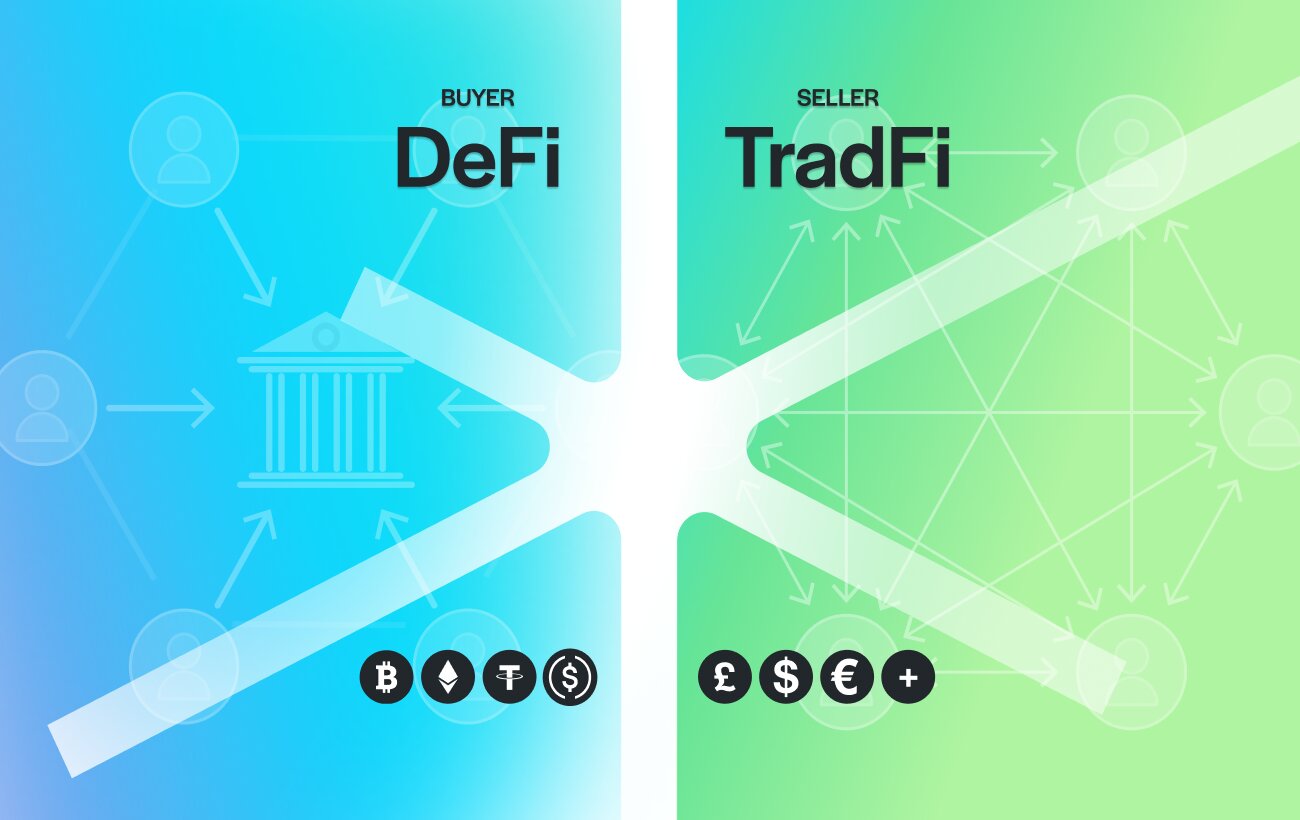

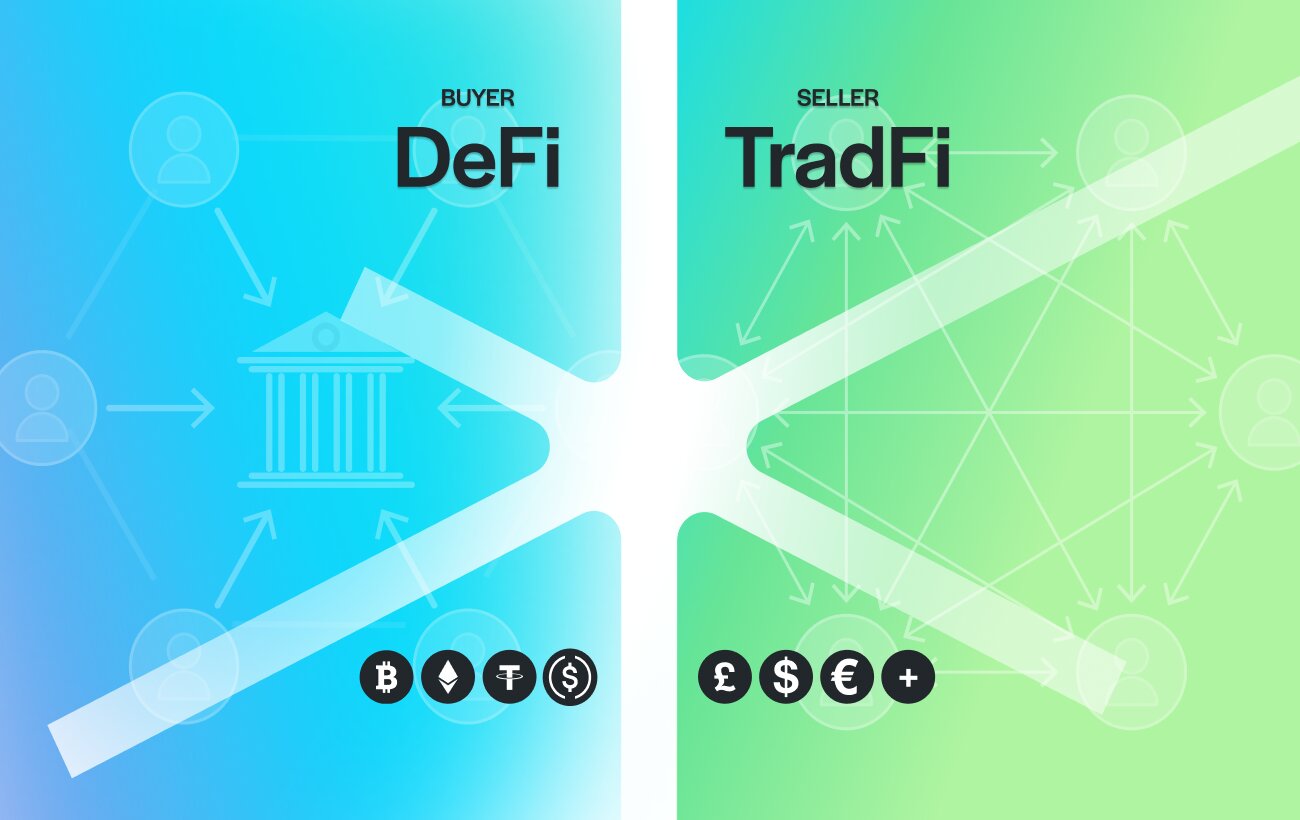

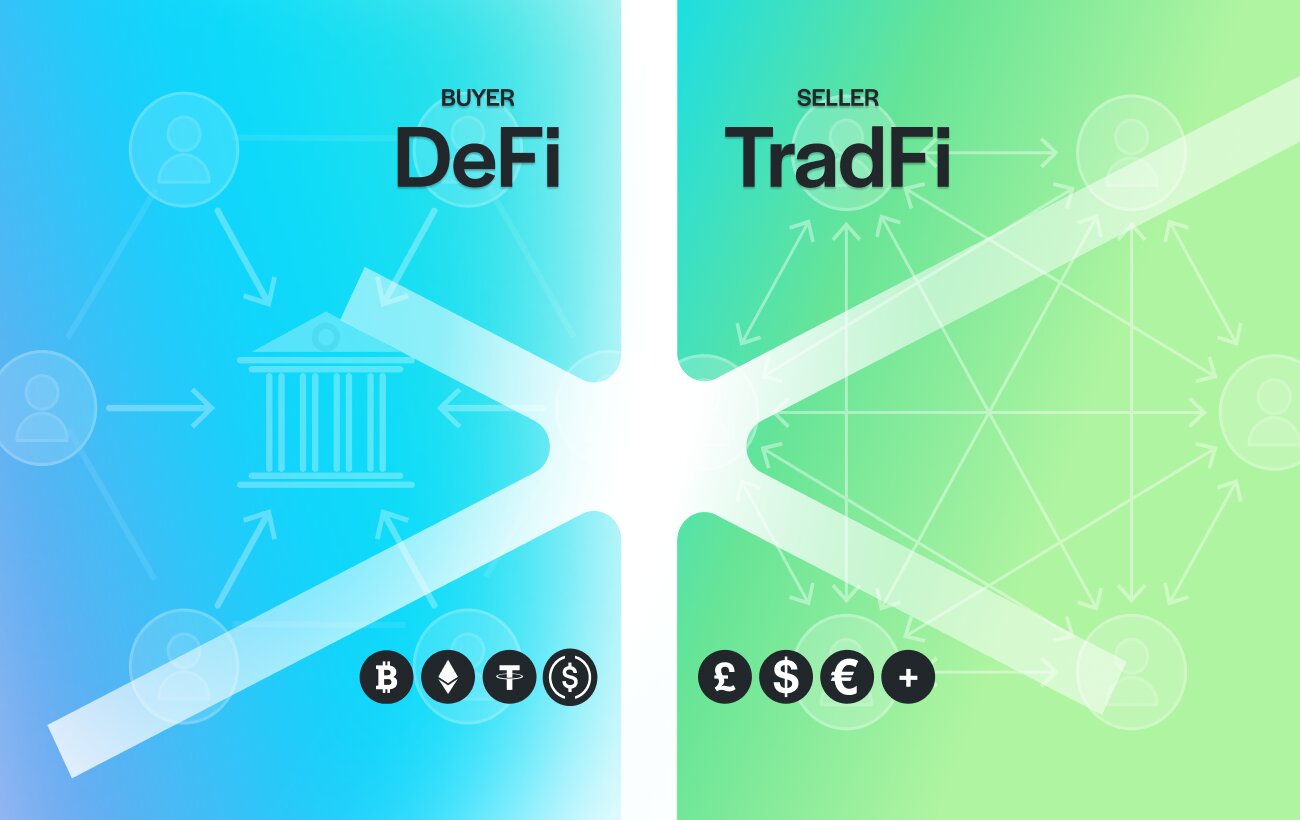

In other words, the payer uses stablecoins, while the recipient experiences a normal bank transfer.

However, this is where most existing solutions fail to deliver. Read the complete 2026 guide here.

How TrustLinq enables you to spend crypto anywhere

TrustLinq was designed specifically to solve this problem.

It enables non-custodial crypto-to-third-party fiat payments.

Here is how it works.

You fund a payment using self-custodial stablecoins.

TrustLinq handles the settlement into fiat.

The recipient receives a standard bank transfer in their local currency.

There is no requirement for the payer to hold a bank account.

At the same time, the recipient never needs to touch crypto.

Importantly, TrustLinq does not custody crypto or fiat.

This makes it possible to use crypto for real-world payments without changing how businesses operate today.

Designed for individuals and companies holding crypto

TrustLinq works for both personal and business use cases.

Individuals use it to:

- Pay rent or utilities

- Settle invoices

- Cover international expenses

- Pay service providers who only accept fiat

Companies use it to:

- Pay suppliers and contractors

- Handle cross-border expenses

- Use stablecoins operationally

- Avoid maintaining multiple bank accounts

In all cases, the experience for the recipient stays exactly the same.

Why this approach outperforms cards and gateways

Spending crypto through cards or merchant gateways introduces hidden constraints.

Cards are limited by geography and networks.

Gateways require merchant integration.

Off-ramps require bank ownership and manual steps.

TrustLinq removes these constraints by separating funding from settlement.

Crypto is used where it makes sense, on the payer side.

Fiat is delivered where it is required, on the recipient side.

This separation allows crypto holders to spend crypto anywhere.

A new category, not another workaround

TrustLinq does not fit into existing labels like exchange, off-ramp, or payment gateway.

It operates in a distinct category.

Non-custodial crypto-to-third-party fiat payments.

This category addresses a specific and growing problem. Crypto holders want to use their assets without forcing the rest of the world to change.

Why stablecoins make this possible

Stablecoins are the foundation of practical crypto payments.

They reduce volatility.

They move globally.

They integrate cleanly with fiat settlement.

According to the Bank for International Settlements, stablecoins are increasingly used for real economic activity rather than speculation alone.

TrustLinq is built around this reality.

When spending crypto anywhere matters most

This approach becomes essential when:

- You operate internationally

- Your counterparties require fiat

- You want speed without friction

- You want compliance without complexity

Instead of asking who accepts crypto, you simply pay as usual.

FAQs

Yes. You can fund payments with stablecoins while recipients receive fiat by bank transfer, even if they do not accept crypto.

No. From their perspective, it is a normal fiat payment.

No. Payments are funded directly from self-custodial stablecoins.

No. Cashing out (off-ramping) moves funds to your own bank account. TrustLinq enables direct third-party payments.

Yes. Many companies use it to settle invoices and operational expenses globally.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.