Swiss Crypto Regulations and Compliance

Swiss crypto regulations have positioned Switzerland as one of the most trusted jurisdictions for digital asset compliance. Its clear legal framework and pragmatic oversight have helped the country become a global leader in crypto regulation.

As crypto assets increasingly interact with traditional financial systems, regulatory clarity becomes essential. Switzerland’s structured and transparent approach provides legal certainty for businesses, investors, and payment infrastructure operating at the intersection of crypto and fiat.

This regulatory environment makes Switzerland uniquely suited for companies building compliant crypto funded fiat settlement solutions.

Swiss crypto regulations for digital assets

At the core of Switzerland’s crypto regulation is a technology neutral legal framework that recognises distributed ledger technology as part of the financial system.

Swiss law provides clarity around payment tokens, asset tokens, and utility tokens. This distinction allows businesses to operate with legal certainty while supporting innovation across areas such as asset tokenisation and new financial instruments.

Rather than creating a separate crypto regime, Switzerland integrates digital assets into its existing financial market laws. This approach reduces ambiguity and ensures consistent treatment across traditional and digital finance.

Oversight and supervision in Switzerland

Crypto related activities in Switzerland are governed by established financial laws and supervised through a combination of regulatory authorities and recognised self regulatory organisations.

The Swiss Financial Market Supervisory Authority sets the regulatory perimeter and issues guidance on how existing laws apply to digital assets. Operational supervision for many financial intermediaries, including crypto service providers, is carried out through recognised SROs under the Anti Money Laundering Act.

TrustLinq operates as a Swiss regulated financial intermediary and is supervised under the AMLA framework through a recognised Swiss SRO. This structure ensures compliance while allowing operational flexibility within clearly defined legal boundaries.

Key laws governing crypto activity

Several Swiss laws form the foundation of crypto compliance.

The Anti Money Laundering Act requires financial intermediaries to implement strict KYC, transaction monitoring, and risk management procedures. These obligations apply equally to crypto funded payment activities.

The Financial Institutions Act defines licensing requirements for entities providing financial services. It ensures that firms operating in the crypto space meet professional, organisational, and compliance standards.

The Financial Market Infrastructure Act governs trading venues and settlement systems. While TrustLinq does not operate a trading venue, this framework supports the broader integrity of Switzerland’s financial markets.

Together, these laws create a coherent regulatory environment for compliant crypto to fiat activity.

Legal certainty for investors and businesses

Switzerland’s regulatory clarity extends beyond payments.

The country supports regulated investment structures for digital assets, including collective investment schemes and crypto based funds. These structures operate under established financial law, offering investors protection and transparency.

This consistency across payments, investments, and infrastructure reinforces Switzerland’s reputation as a jurisdiction where crypto innovation can scale responsibly.

Swiss crypto regulations for crypto funded fiat payments

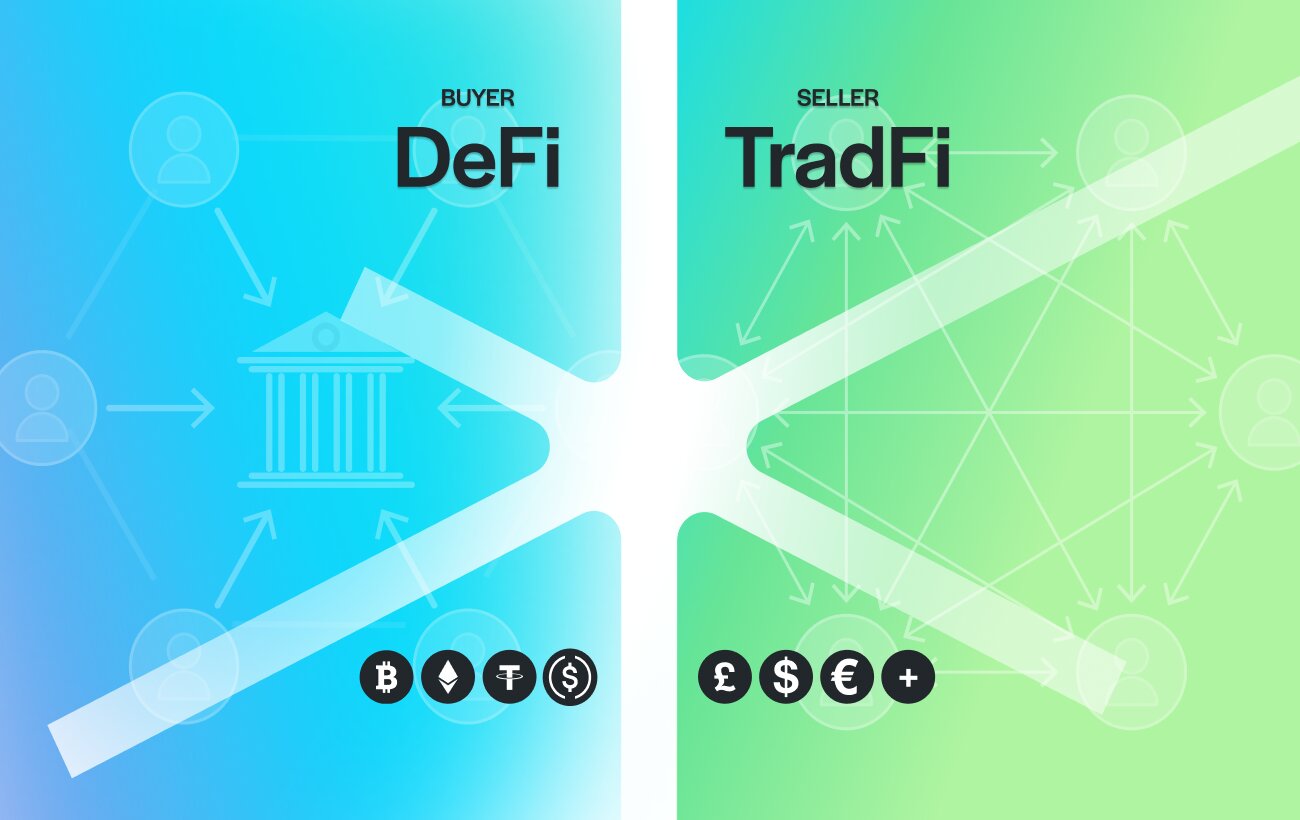

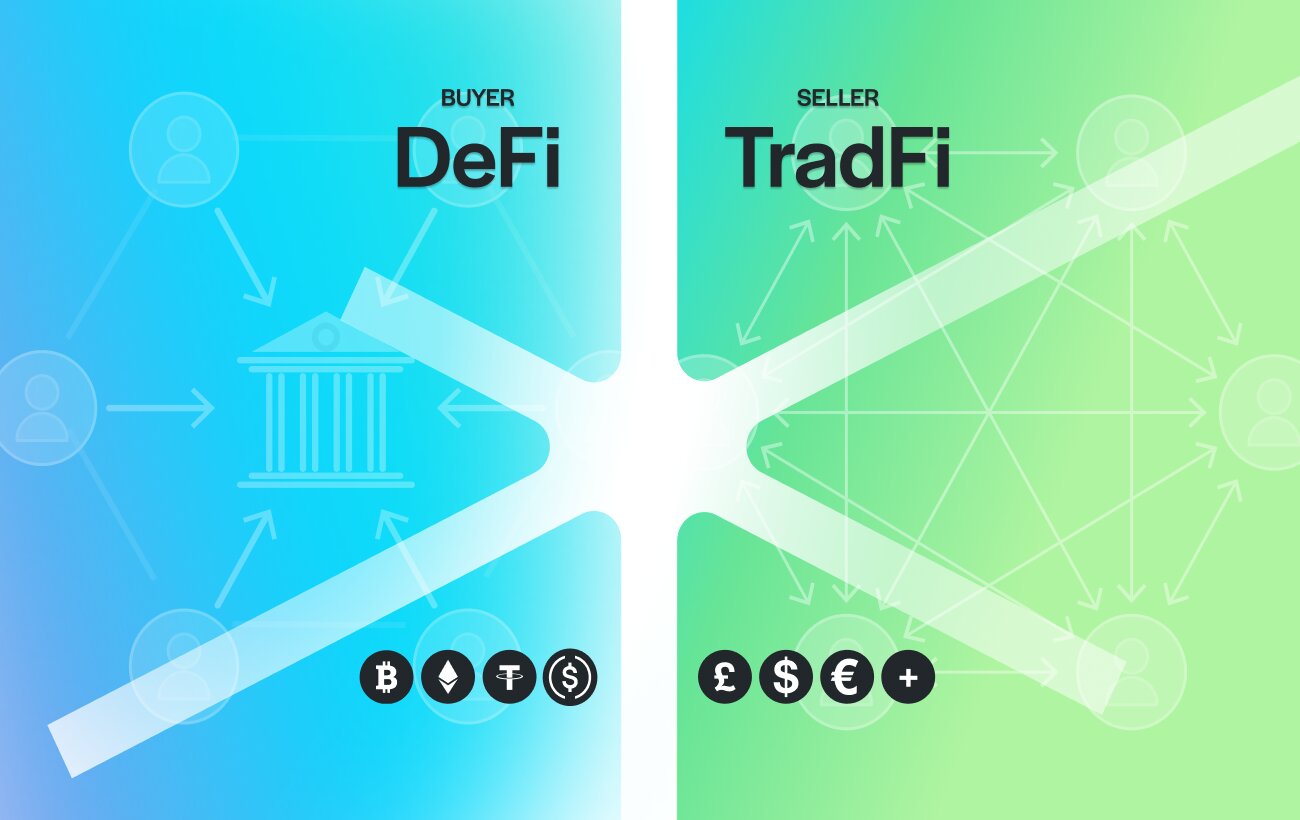

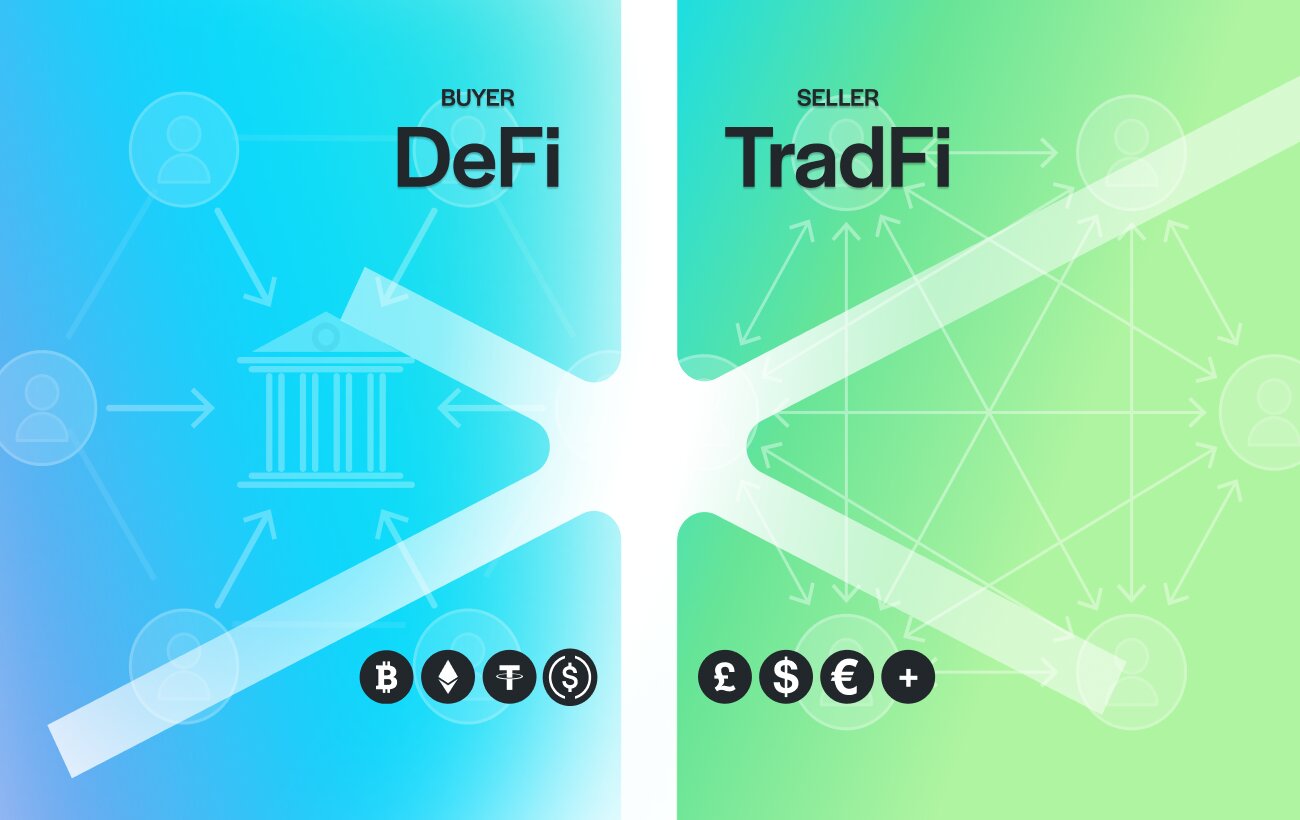

Swiss regulation enables practical use cases for crypto without compromising compliance. This compliance framework also supports crypto funded fiat settlement, a payment category that enables self custodial crypto to fund regulated fiat payments to third parties.

TrustLinq leverages this framework to enable crypto funded fiat settlement. Individuals and businesses can fund payments from self custodial crypto while delivering fiat directly to third party bank accounts.

The payer does not need a traditional bank account. The recipient does not need to accept crypto. Funds do not enter TrustLinq custody.

By separating crypto funding from fiat settlement, this model aligns with Swiss regulatory principles while supporting real world payment needs.

Why Switzerland matters for the future of crypto payments

The long term success of crypto depends on its ability to interact with existing financial systems. Switzerland recognises this reality.

Rather than forcing adoption through disruption, Swiss regulation enables integration. It allows crypto to function as a funding layer while respecting how recipients, banks, and regulators operate today.

This balance makes Switzerland a natural home for crypto funded fiat settlement infrastructure.

TrustLinq’s role within the Swiss regulatory framework

TrustLinq operates within Switzerland’s established compliance environment to deliver regulated crypto funded fiat payments.

By adhering to Swiss AML requirements and operating under recognised supervision, TrustLinq provides legal certainty for both individuals and businesses using crypto for real economic activity.

This approach allows users to pay suppliers, service providers, and merchants worldwide without requiring crypto acceptance or custodial risk.

Why this regulatory approach matters

Crypto adoption continues to grow faster than merchant acceptance. Bridging this gap requires more than technology. It requires regulation that supports real world usage.

Switzerland’s crypto framework provides that foundation. It enables compliant settlement models that allow crypto to be used responsibly, securely, and at scale.

As global regulation continues to evolve, Switzerland remains a reference point for how crypto and traditional finance can coexist.

FAQs

Crypto funded fiat settlement is a payment model where funds originate from self custodial crypto and settle directly in fiat to a third party bank account. The recipient receives a standard bank transfer and does not need to accept or handle crypto.

A crypto off-ramp moves crypto into the payer’s own bank account before any payment occurs. Crypto funded fiat settlement enables direct payments to third parties without requiring the payer to first receive fiat or maintain a bank account.

No. Recipients receive fiat through traditional banking rails. They do not need a wallet, crypto knowledge, or any change to their existing payment workflows.

Yes. When operated correctly, crypto funded fiat settlement aligns with Swiss crypto regulations. It falls under existing financial and AML frameworks that govern regulated financial intermediaries, including KYC, transaction monitoring, and risk controls.

This model is designed for individuals and businesses that hold crypto operationally and need to pay rent, invoices, suppliers, service providers, or international counterparties in fiat without relying on merchant crypto acceptance.

Start using crypto within a regulated framework

TrustLinq enables crypto funded fiat settlement under Swiss regulation for individuals and businesses worldwide.

Register once and use your self custodial crypto to pay any third party in fiat, without custody and without forcing merchants to change how they operate.

→ Register with TrustLinq