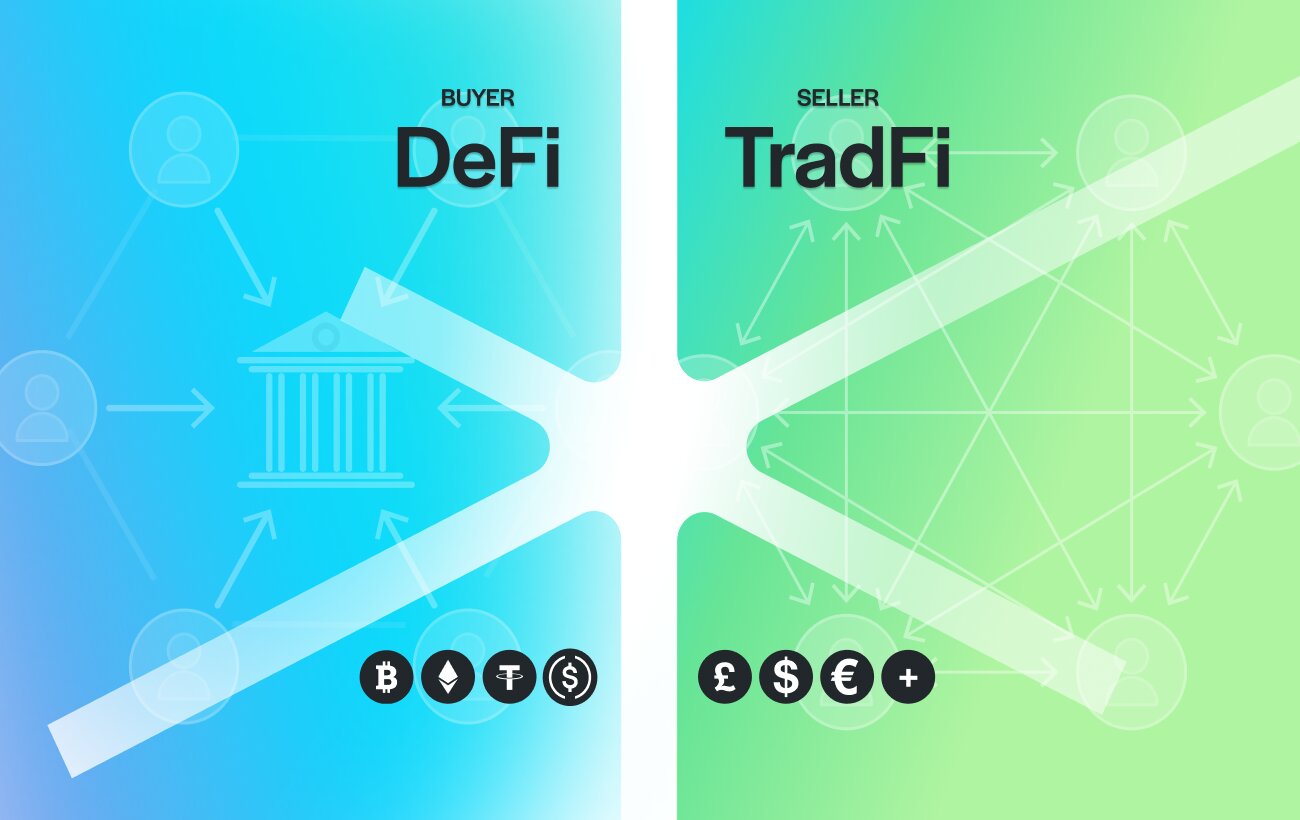

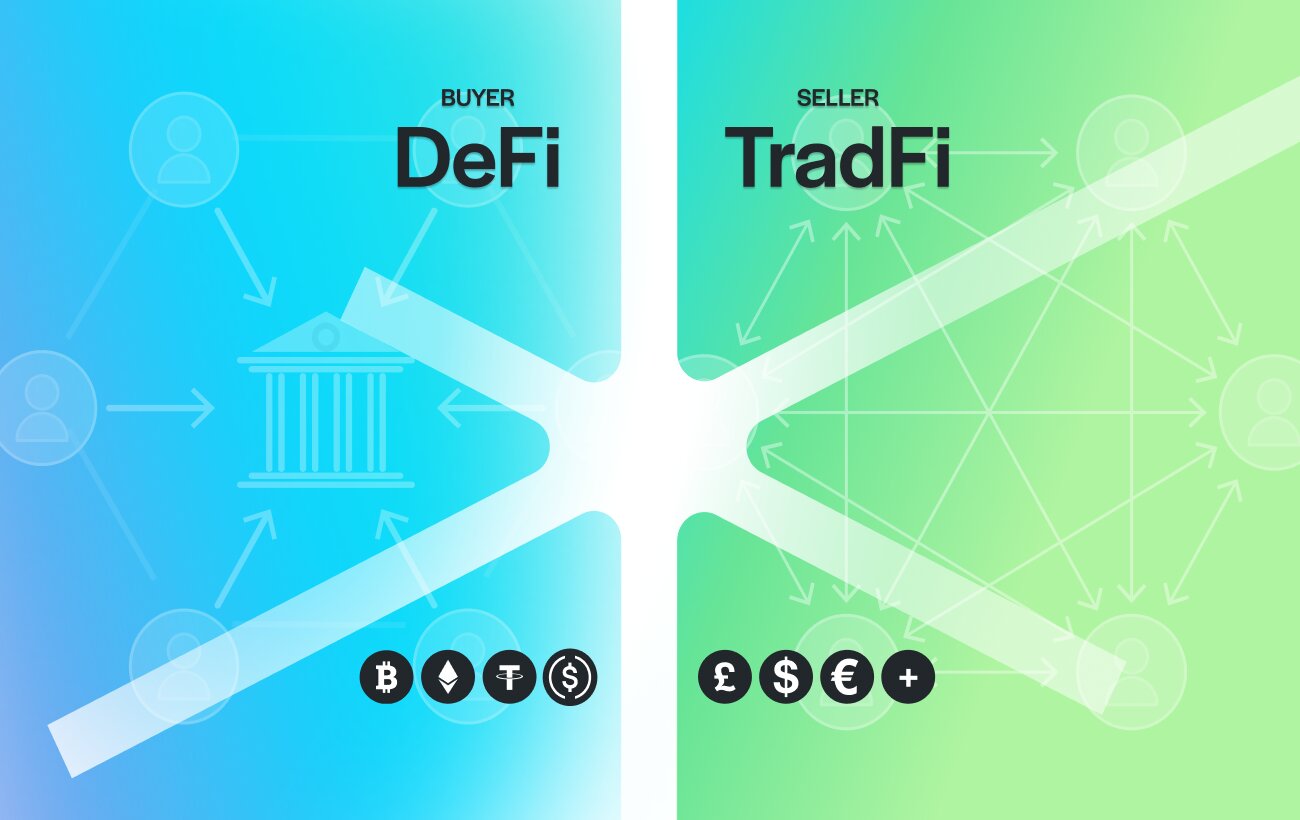

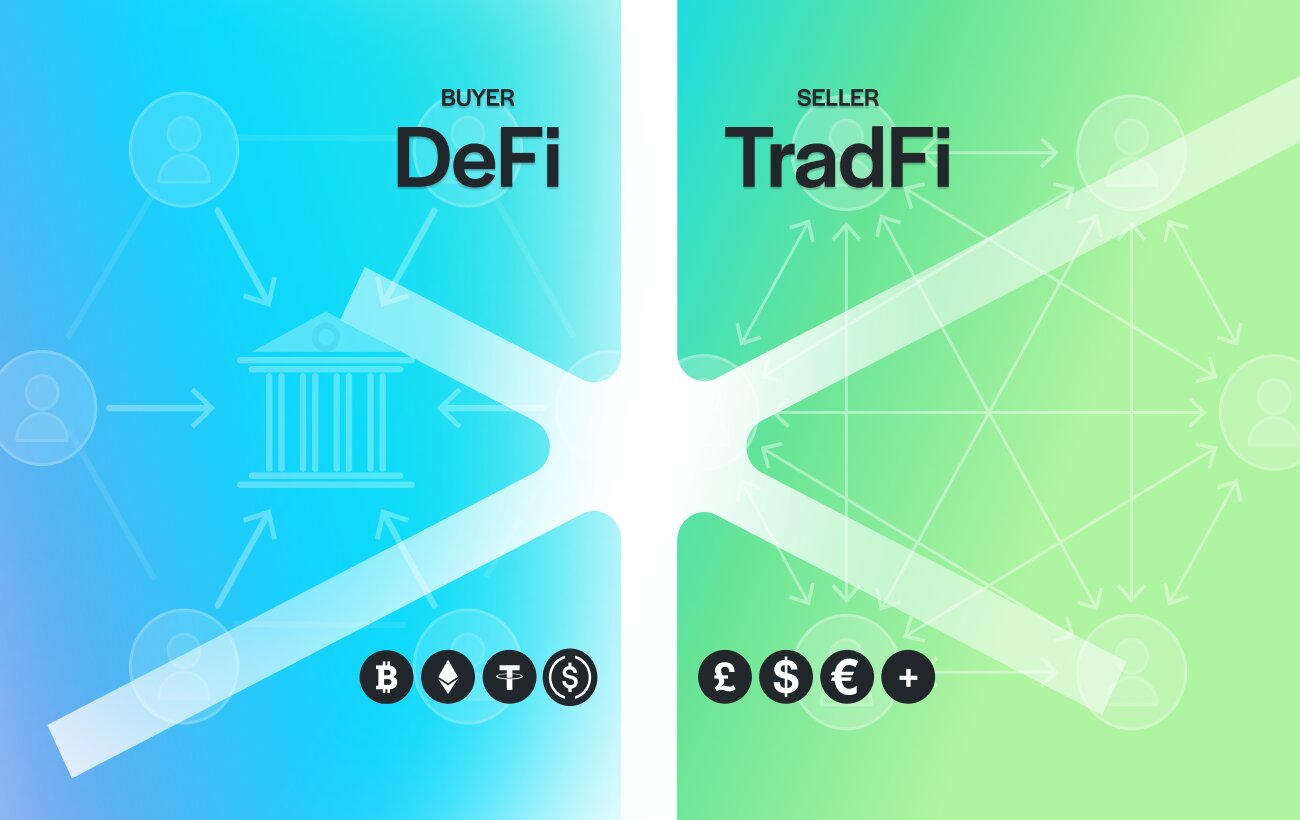

Millions of clients worldwide hold digital assets, yet most cannot use them to pay traditional businesses. At the same time, many companies avoid crypto because they want to avoid technical setup, operational changes, or exposure to digital assets. This creates a large and underserved gap. TrustLinq closes it by allowing businesses to accept crypto without integration, without changing how they operate, without handling cryptocurrency, and at no cost.

To welcome crypto-holding clients without changing how your business operates, you can accept crypto without integration through the TrustLinq Partner Program.

Why Businesses Want to Accept Crypto Without Integration

A growing number of companies want to offer crypto but prefer to avoid plug-ins, merchant systems, or API integrations. Service providers, consultants, agencies, real estate firms, and international businesses often rely on simple invoicing. They do not need a gateway. They want a frictionless way for clients to fund invoices with crypto while the business continue receiving fiat.

As a result, many businesses search for a straightforward option. Can we accept crypto without integration?

However, traditional providers almost always require technical integration and setup. This discourages companies that want a clean, simple solution. TrustLinq introduces a new model that removes this barrier entirely.

The Market Gap Created by Limited Crypto Acceptance

More than 580 million people now hold crypto. However, fewer than 0.003 percent of businesses provide a direct way for clients to pay using digital assets. Many companies avoid crypto payments because integrations require time, tools or internal adjustments. This leaves a large and untapped customer segment.

As a result, high value clients, especially those paying across borders, increasingly rely on stablecoins because they avoid delays and reduce transfer uncertainty. Therefore, businesses that can accept crypto without integration position themselves to serve a fast-growing group of global clients.

In addition, independent research highlights the rising demand for simple digital asset payment options.

If your business wants to welcome crypto-holding clients without changing how it operates, you can explore the TrustLinq Partnership Program.

How Businesses Accept Crypto Without Changing Their Process

TrustLinq enables businesses to accept crypto without installing anything and without changing internal systems. The workflow remains exactly the same.

Step one. You issue your normal invoice.

Step two. Your client signs up on TrustLinq.

Step three. Your client funds the invoice using crypto from a self custodial wallet.

Step four. TrustLinq settles fiat directly into your bank account in more than seventy supported currencies.

Moreover, this process requires no technical integration, no plugins, no merchant tools, and no operational changes. You never handle cryptocurrency. You simply continue operating exactly as you do today, while your client uses crypto on their side.

You can also learn why most traditional off-ramps fall short in How to Off-Ramp Crypto Safely and What to Do Instead.

Why There Is No Integration Needed

Most crypto solutions are built for merchants and point-of-sale environments. TrustLinq uses a different model. The client completes the crypto funding on their side. TrustLinq handles the settlement and compliance process. The business receives fiat as a standard bank transfer. Because everything related to digital assets happens on the client’s side, no integration is required.

Consequently, this structure gives companies a modern payment method without introducing new workflows.

For more insight into how businesses use stablecoins for expenses, read How to Use Crypto for Business Expenses and Pay in Fiat.

Zero Cost and Zero Exposure to Cryptocurrency

Many businesses assume they must adopt new tools or pay fees to support crypto payments. TrustLinq eliminates both concerns. Clients pay a small fee during funding, while the business receives the full amount in fiat.

Furthermore, you never touch cryptocurrency. There is no exposure to volatility, custody or blockchain complexity. You only receive a standard bank transfer in your chosen fiat currency.

Why This Matters for International and High Value Clients

Businesses that serve international clients or issue larger invoices benefit the most. Many global clients prefer paying with stablecoins because transfers are fast, reliable and widely supported. By allowing clients to pay invoices with crypto without integration, a business instantly becomes more attractive to this segment.

Swiss Regulation and Privacy

TrustLinq operates under Swiss financial regulation. Payments undergo compliance checks following Swiss AML standards, while maintaining strong privacy protections. This gives confidence to both businesses and clients.

Becoming a TrustLinq Partner

Businesses that work with TrustLinq gain immediate advantages such as:

New global clients who hold and spend digital assets

Zero operational changes or workflow adjustments

No integration or technical setup

No cost for offering the option

Marketing support for partnership announcements

Fiat settlement in more than seventy currencies

To learn more about welcoming crypto paying clients, visit: TrustLinq Partner Program.

You can also read how individuals pay invoices with stablecoins in How to Pay Invoices With Stablecoins Without a Bank Account.

What a Future With Simple Crypto Payments Looks Like

Stablecoins continue to gain traction. As adoption grows, more clients expect businesses to offer modern, flexible payment options. By accepting crypto payments without integration, companies can meet this demand naturally. Stablecoins will increasingly become an everyday settlement method for professional services, cross-border work and high value transfers.

Why Solving This Problem Matters Today

Many businesses assume that accepting crypto is complex. TrustLinq removes that barrier completely. The business issues an invoice. The client pays in crypto. The business receives fiat exactly as it always has.

Finally, crypto adoption cannot expand into daily financial life until businesses can accept it without integration. TrustLinq closes that gap and makes the process accessible to all.

TrustLinq lets clients pay invoices using crypto through their own wallets while the business receives a normal bank transfer in fiat. No plugins, gateways or technical setup are required.

Yes. Clients fund the payment with stablecoins and the business receives fiat in more than seventy currencies without touching cryptocurrency.

Yes. You continue issuing your standard invoices. Your client pays through TrustLinq and you receive the funds as a regular bank transfer.

No. Clients can pay from any self custodial wallet that supports the stablecoin they use, making the process simple and globally accessible.

Stablecoin payments are funded quickly and settled to the business bank account in fiat after standard regulatory checks.

You can either fill out the contact form below or visit our partners page.