Estimated reading time: 5 minutes

Over the past year, crypto adoption has become a recurring headline. Major financial institutions, payment networks, and regulators are publicly embracing stablecoins, tokenization, and blockchain-based settlement systems. On paper, this looks like a breakthrough moment. Crypto appears to be entering the financial mainstream.

However, despite this surge in institutional activity, most businesses still cannot use crypto in their daily operations. They cannot accept it easily, they cannot rely on it for payments, and they cannot integrate it into existing workflows without friction.

This disconnect reveals a deeper issue. Crypto adoption is advancing at the infrastructure level, but crypto usability for everyday businesses remains largely unsolved.

Below, we examine some of the most prominent recent adoption headlines and explain why they still do not address the reality faced by the 99 percent of businesses that rely on traditional bank transfers.

Visa Expands USDC Settlement for U.S. Institutions

Visa announced the expansion of USDC settlement capabilities for U.S. institutions, positioning stablecoins as part of its core settlement infrastructure.

This is an important infrastructure milestone. It signals that stablecoins are becoming acceptable tools for interbank and network-level settlement. It also shows that payment giants are preparing for a future where digital currencies coexist with traditional systems.

However, this development does not change how most businesses get paid.

Businesses are not settlement participants inside Visa’s infrastructure. They are endpoints. They issue invoices, receive payments, and reconcile accounts in fiat. A backend settlement upgrade does not automatically give a consulting firm, a supplier, or a landlord the ability to accept crypto without integration or operational change.

In other words, institutional settlement adoption does not translate into real-world usability for businesses.

SWIFT Adds a Blockchain-Based Ledger to Its Infrastructure

SWIFT announced plans to introduce a blockchain-based shared ledger to modernize cross-border transaction coordination.

This announcement matters at a systemic level. SWIFT sits at the center of global interbank messaging. Any modernization effort there signals long-term commitment to digital settlement efficiency.

Yet again, the usability gap remains.

Businesses do not interact with SWIFT directly. They receive bank transfers after the system completes its internal messaging and settlement processes. Even if SWIFT operates on new rails behind the scenes, businesses still require payments to arrive as standard fiat transfers into local accounts.

The technology improves financial plumbing, but it does not remove the practical barrier businesses face when clients want to pay with digital assets.

J.P. Morgan Launches a Tokenized Money Market Fund

J.P. Morgan Asset Management launched its first tokenized money market fund on a public blockchain, marking a major moment for tokenized financial products.

This move validates tokenization as a serious financial tool. It improves asset transferability, settlement timing, and programmability for eligible investors.

However, tokenized funds do not solve payment usability.

A business cannot pay invoices with a tokenized fund. A supplier cannot receive a settlement without conversion back to fiat. Tokenization enhances capital markets, but it does not help businesses accept payments from clients who hold crypto.

Tokenization grows on-chain value, but it does not bridge the gap to off-chain business settlement.

U.S. Regulators Approve Crypto Firms for Trust Bank Charters

U.S. regulators granted preliminary approvals for several crypto firms to pursue national trust bank charters.

This signals regulatory maturation. Stablecoin issuers and crypto firms are being pulled into formal supervisory frameworks. This improves confidence and reduces legal uncertainty.

Still, regulation alone does not equal usability.

Even with regulatory clarity, businesses still ask the same practical questions. Will I receive fiat? Will my accounting change? Do I need to handle digital assets? Will my operations become more complex?

Without clear answers that preserve existing workflows, most businesses remain unwilling to engage.

BlackRock’s Tokenized Fund Reaches Major Milestones

BlackRock’s tokenized liquidity fund surpassed significant assets under management milestones, reinforcing the growth of real-world asset tokenization.

This confirms institutional appetite for tokenized assets. It also strengthens the narrative that real-world assets are moving on-chain.

Yet, once again, usability remains unresolved.

Tokenized assets cannot be spent directly by businesses. They require conversion into fiat to meet real-world obligations. Until that conversion becomes seamless and invisible to recipients, tokenization remains a financial innovation rather than a payment solution.

The Usability Gap Behind the Headlines

Across all these headlines, a pattern emerges.

Institutions are modernizing settlement, custody, and asset issuance. These efforts reduce friction inside financial systems. However, they do not change how businesses operate day to day.

Businesses want simplicity. They want to issue invoices as usual. At the same time, they want to receive bank transfers in fiat. Most importantly, they do not want technical integrations, crypto custody, or exposure to digital asset volatility.

As long as crypto payments require businesses to adapt, adoption will stall.

This is why crypto adoption can be real in press releases while remaining absent from everyday business payments.

What Real Crypto Adoption Looks Like

Real adoption does not require businesses to learn new financial systems.

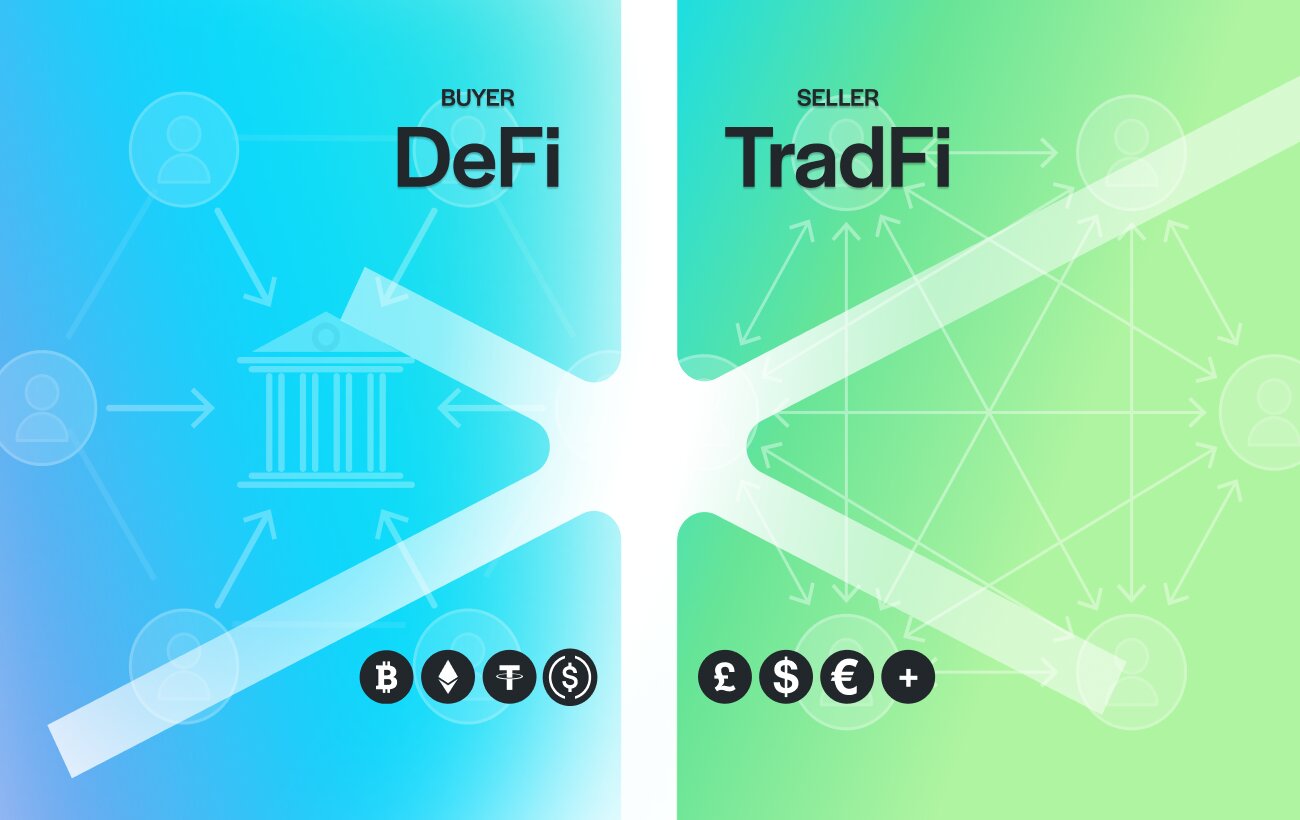

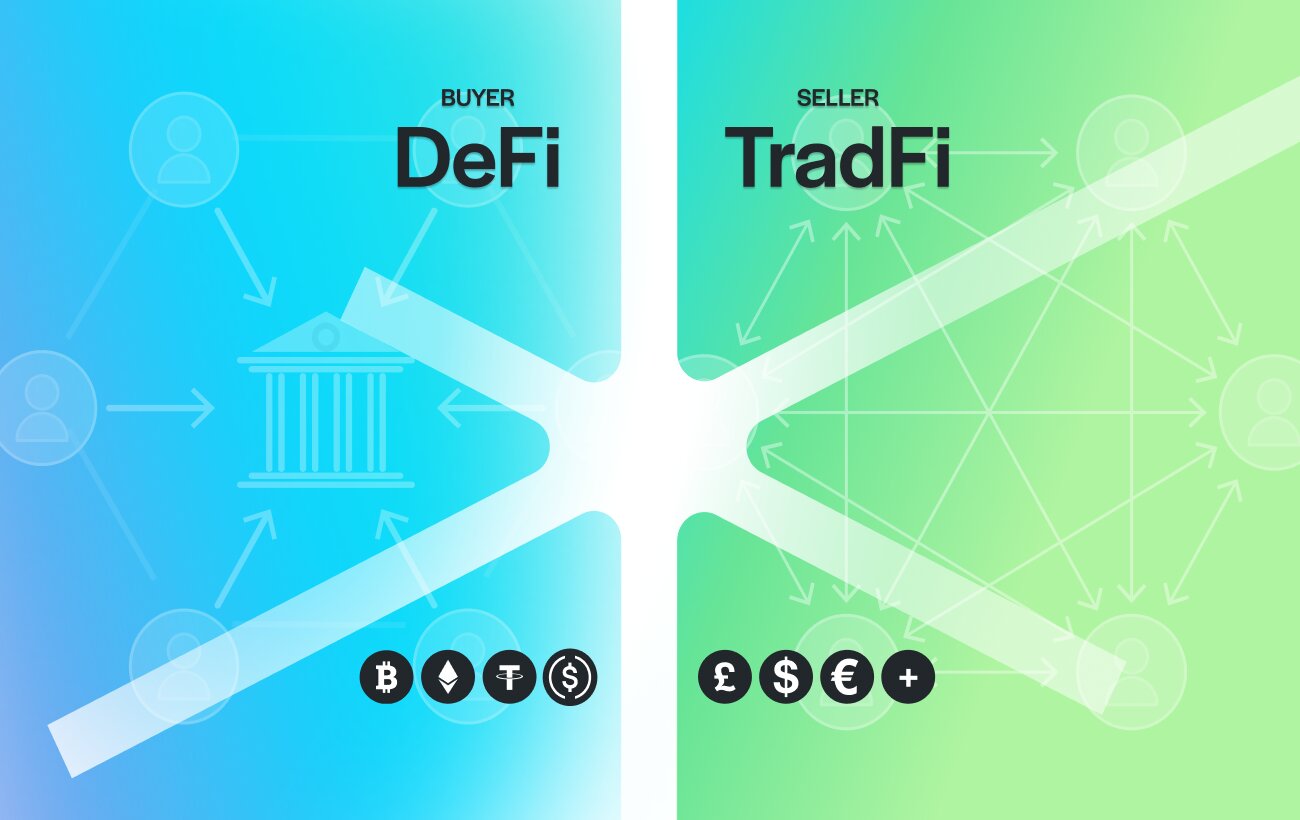

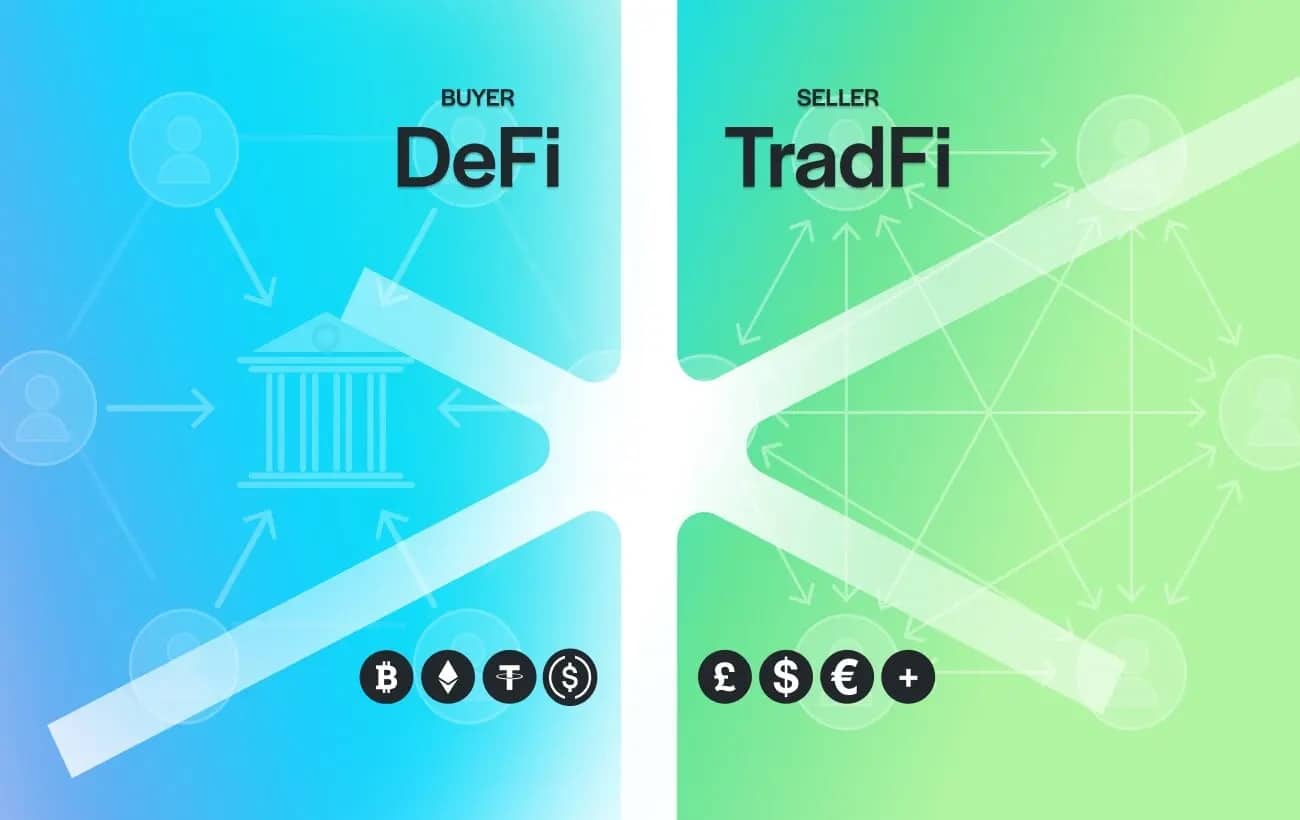

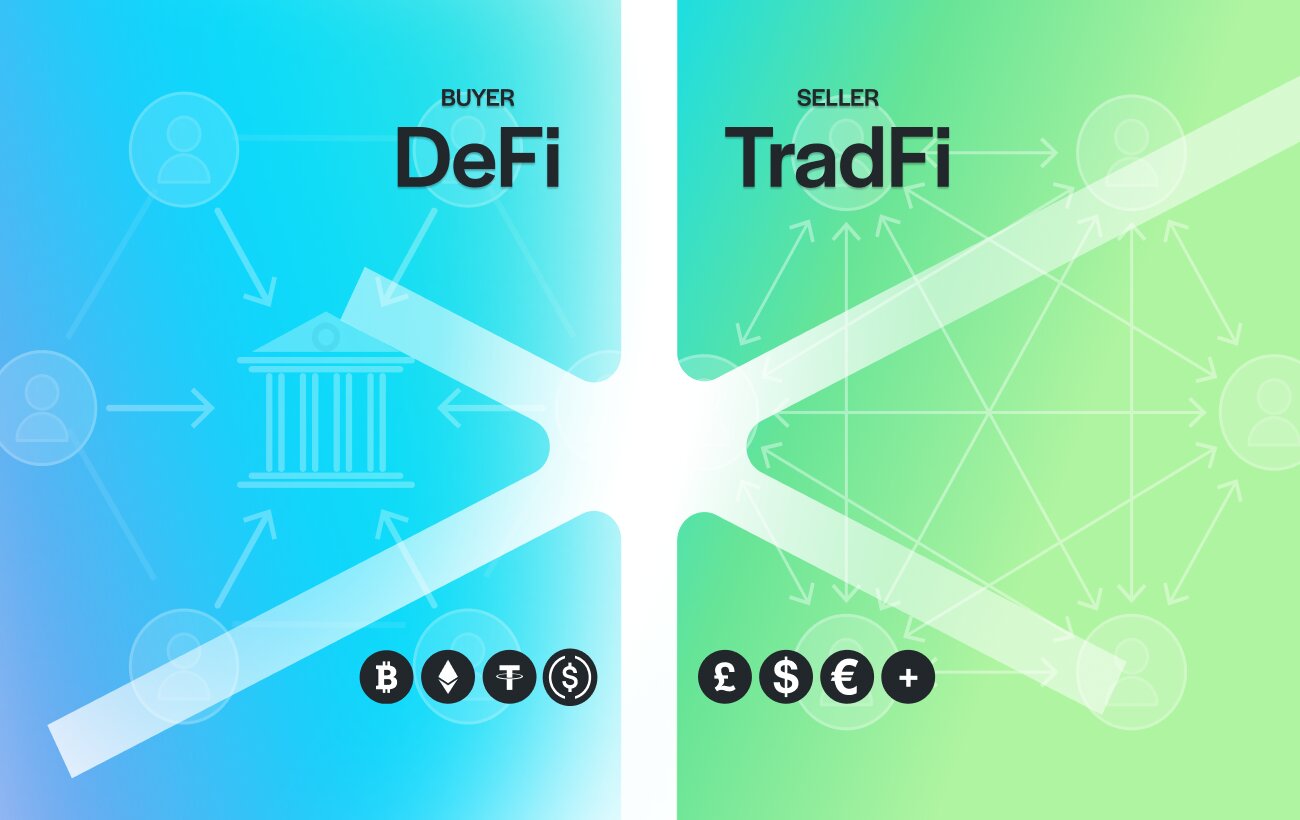

Real adoption looks like this:

- A business issues a normal invoice

- A client pays using digital assets on their side

- The business receives a standard fiat bank transfer

- Accounting and workflows remain unchanged

When this becomes normal, crypto stops being a parallel system and starts behaving like money.

Why This Matters Now

Institutional adoption is a positive signal. It shows that crypto infrastructure is maturing.

But until usability reaches the real economy, adoption remains incomplete.

The next phase of growth will not be driven by faster token movement. It will be driven by settlement models that respect how businesses already operate.

Crypto will not become mainstream because businesses change for crypto. It will become mainstream when crypto adapts to businesses.

Further Reading:

Crypto’s Multi-Billion Dollar Usability Problem Explained

How to Use Crypto for Business Expenses and Pay in Fiat

Real World Assets in Crypto: What RWA Means and Why TrustLinq Is the Missing Utility Layer

FAQ:

Adoption is happening at the infrastructure level, while usability for everyday business payments remains unresolved.

Stablecoins remove volatility but do not remove the need for fiat settlement, which businesses still require.

Integration complexity, operational change, and digital asset exposure discourage adoption.

Tokenization improves financial products but does not solve settlement into traditional bank accounts.

Crypto payments must reach businesses as normal fiat bank transfers without requiring workflow changes.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.